The latest figures of the FTTH Market Panorama - prepared by IDATE for the FTTH Council Europe - were released at the FTTH 2018 conference in Valencia.

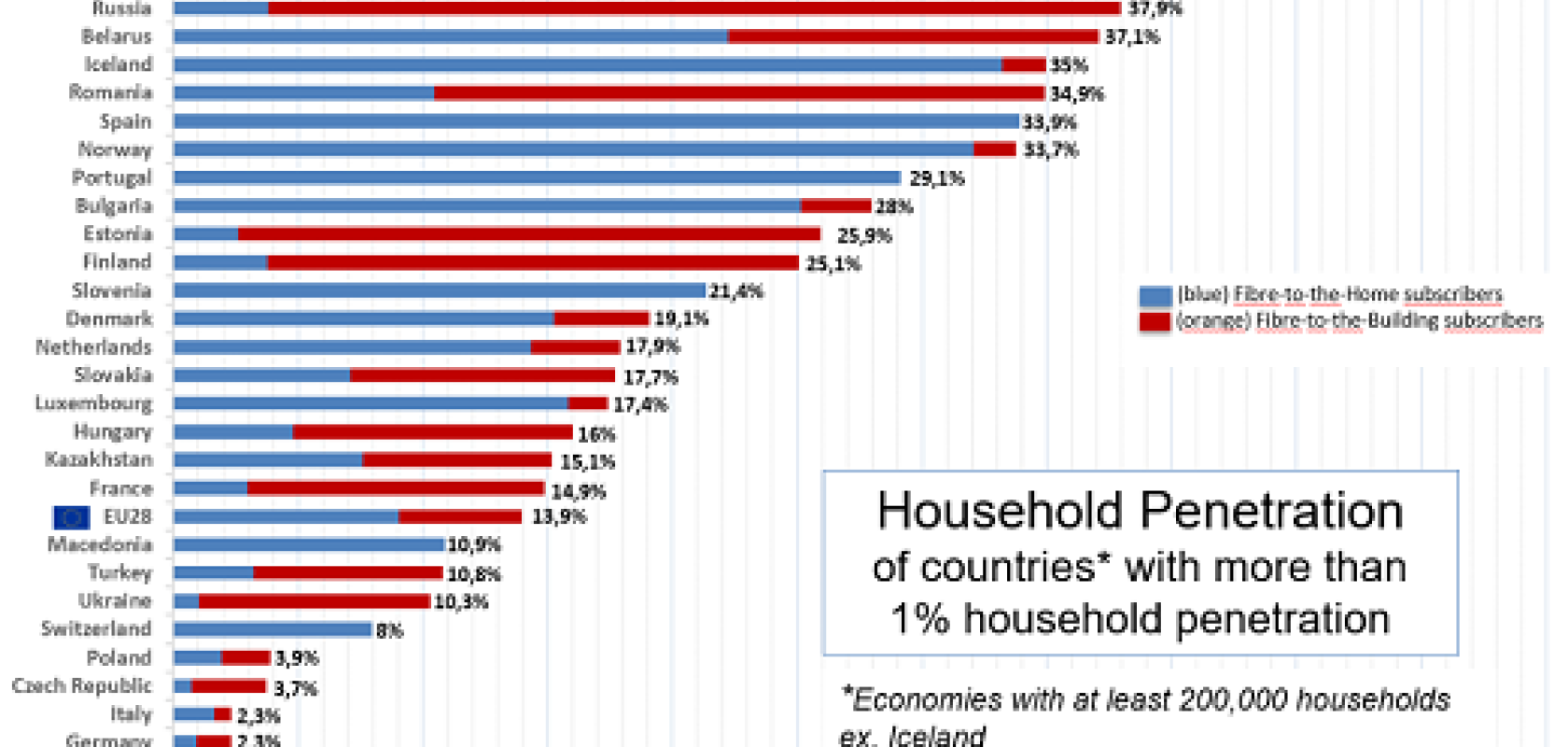

The figures demonstrate that the number of fibre to the home (FTTH) and fibre to the building (FTTB) subscribers in Europe has increased, with more than 5.1 million FTTH/B subscribers in the EU39 by the end of September 2017 – a 20.4 per cent rise on September 2016.

Ireland makes its entry to the ranking this year, with a subscriber penetration rate of 1.7 per cent (out of all homes in the country) and a take-up rate of 9.6 per cent (out of households covered). By September 2017, the FTTH/B subscriber base in Ireland had increased by 73 per cent (29,446 subscribers) and FTTH/B homes passed by a staggering 254 per cent (306,285 homes passed).

The number of homes passed in EU39 increased to reach more than 148 million, representing a growth of 16 per cent compared to September 2016. Meanwhile, the take-up rate improved to 34.8 per cent in the EU39, up from 29.9 per cent the previous year. Take-up in the EU28 reached 32.4 per cent.

Looking at the countries, a significant increase in new subscribers was seen in Russia, which added 1,826,000 new FTTH/B subscribers. Spain also experienced a considerable growth with 1,612,371 new FTTH/B subscribers, and France added 1,067,780 new subscribers.

The new market panorama shows that in the European region, private players (former incumbents and alternative operators) are deploying more FTTx networks (56% of the total players) in comparison to other players such as public operators and power utilities. More alternative operators are also deploying FTTH/B, with a contribution of about 54 per cent of the total FTTH/B players.

Another notable trend is the evolution of fibre technologies over the last year; the study revealed that the FTTH architecture is starting to overtake FTTB (55 per cent FTTH in September 2017).

Finally, for the first time the study distinguishes between the ‘total of homes passed’ which are counted once, independently from the number of operators which cover them, and the ‘total of sockets deployed’, reflecting the effort made by players to deploy their own fibre networks. With more numerous players investing in their own infrastructure in the recent years, it is becoming more common that two or more players reach the same household.

‘The findings of the Market Panorama are quite telling, we are now all looking towards the same goal of a fibre rich Gigabit Society,’ commented Ronan Kelly, president of the FTTH Council. ‘We obviously commend the front-runners for their impressive and continuous progress towards FTTH/B but we are also very encouraged by the new trend of operators in countries which do not typically demonstrate a strong appetite for fibre, starting to get involved more intensively in FTTH/B projects. The structure of the market is also changing with the apparition of new types of stakeholders with innovative business models fostering infrastructure competition and making new investments.'

Amongst the rankings, Latvia leads for another year at 50.6 per cent household penetration. Sweden (43.4 per cent) and Lithuania (42.6 per cent) additionally remain in the lead, building on their positions in previous years.

The rankings will be updated next year at the FTTH 2019 Conference in Amsterdam from 12-24 March 2019.