The FTTH Council Europe has revealed its latest market reports at the FTTH Conference in Vienna.

The reports outline the latest figures on fibre deployment trends in Europe: the 2022 Market Panorama; the FTTH Forecasts for 2022-2027; the FTTH/B Global Ranking and the report on FTTH/B in Rural Areas, prepared by Idate.

Reports are based on the latest available data from September 2021 and amongst their findings, the council says that they confirm the continuous progress of fibre roll-out, with full-fibre connectivity being a clear priority for EU authorities, national governments, and market players across Europe.

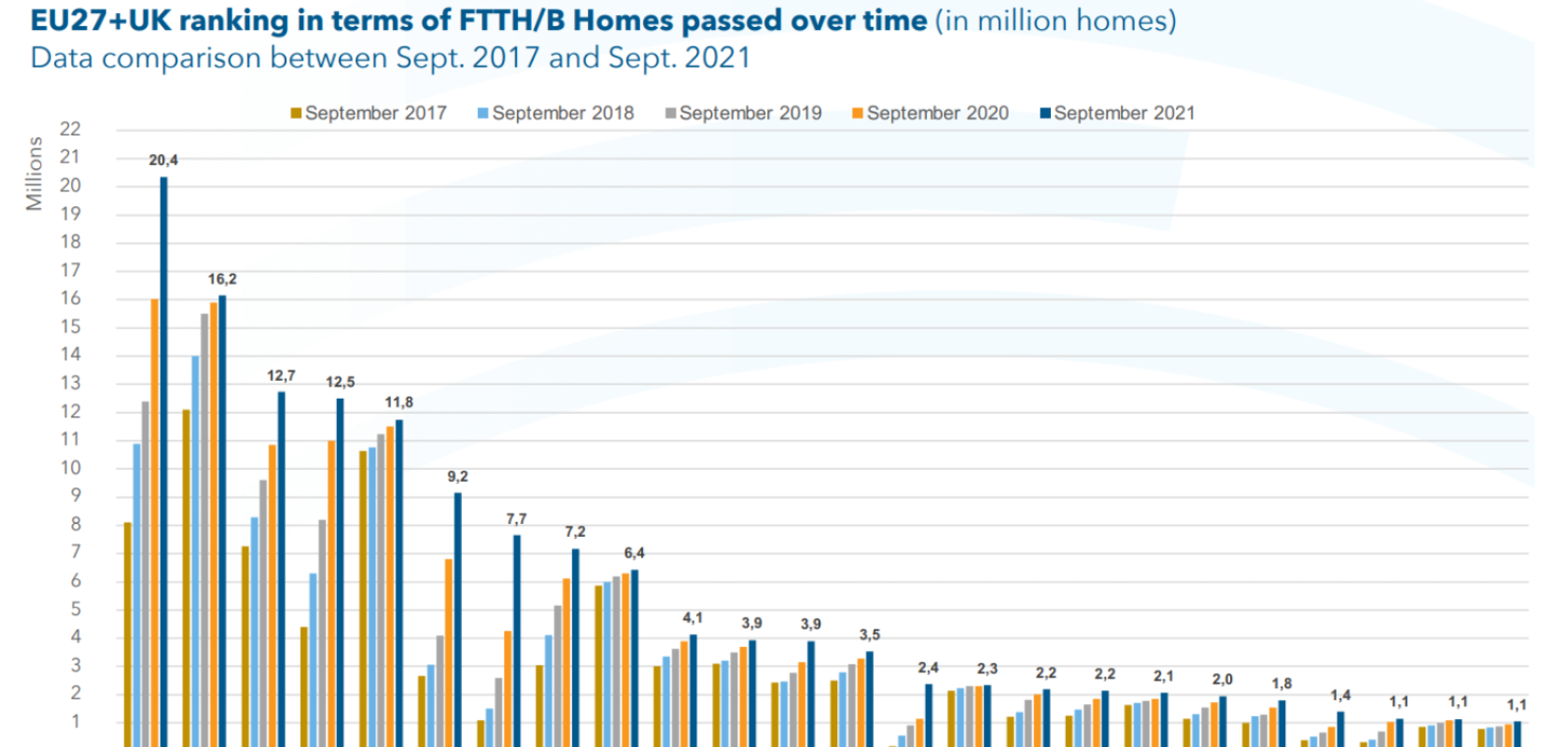

The Market Panorama revealed that the total number of homes passed with FTTH/B in the EU39* countries reached nearly 198.4 million homes in September 2021, compared to 176.3 million in September 2020. The main movers in terms of homes passed in absolute numbers are France (+4.3 million), the UK (+3.4 million), Germany (+2.4 million) and Italy (+1.5 million).

The top five of the annual growth rates in terms of homes passed is headed by Belgium (+109 per cent), Greece (+90 per cent), Cyprus (+83 per cent), United Kingdom (+80 per cent) and Austria (+62 per cent). FTTH/B coverage rate in EU39 now amounts 57 per cent (up by 4.5 per cent) and coverage rate in the EU27 countries plus the UK nearly reaches half of the total homes – 48.5 per cent (up by 4.6 per cent). These data confirm the continuous upward trend which has been observed for several years in a row.

The number of FTTH and FTTB subscribers in the EU39 region reached 96 million, with EU27+UK accounting for 60 per cent. The five fastest growing markets in terms of new subscribers were France (+3.8 million), Spain (+1.2 million), Romania (+1 million), Italy (+820 thousand) and the UK (+765 thousand).

By September 2021, the EU39 FTTH/B take-up rate hit 48.5 per cent (up by 3.6 per cent from the previous year). The growth was even more rapid in the EU27+UK, where the take-up rate reached 52.4 per cent (up by 5.6 per cent).

Interestingly, altnets still constitute the largest part of FTTH/B players, with around 57 per cent of the total homes in the EU39 being passed by alternative ISPs and around 39 per cent by the incumbent ISPs, with the remaining 4 per cent being municipalities/utilities. Overall, there is a strong trend of acceleration of fibre deployment with a firm commitment to cover both urban and rural areas.

In terms of the homes still to be covered, the three countries represent 58 per cent of the total number of households to be covered: Germany with more than 32 million, the UK with more than 21 million and Italy with more than 13 million. All of the top three countries show clear signs of progress being made this year

Global ranking

On to the always eagerly anticipated global ranking, which revealed thay that 20 countries have achieved penetration rate higher than 50 per cent. The global top five ranking is led by UAE with 97 per cent, followed by Singapore (95.8 per cent), China (94.9 per cent), South Korea (91.1 per cent) and Hong Kong (86.2 per cent).

In the European region, for the third consecutive year in a row, Iceland topped the European FTTH/B penetration ranking with a 78.4 per cent penetration rate. It is followed by Spain (68.4 per cent), with Sweden grabbing third place (64.4 per cent). Seven countries passed the 50 per cent penetration rate mark (Iceland, Spain, Sweden, Portugal, Norway, Romania, Latvia). Overall, the report observed that Eastern European and Nordic countries are showing relatively higher penetration rates, mainly due to a proactive state intervention favouring fibre expansion.

Fibre forecasts

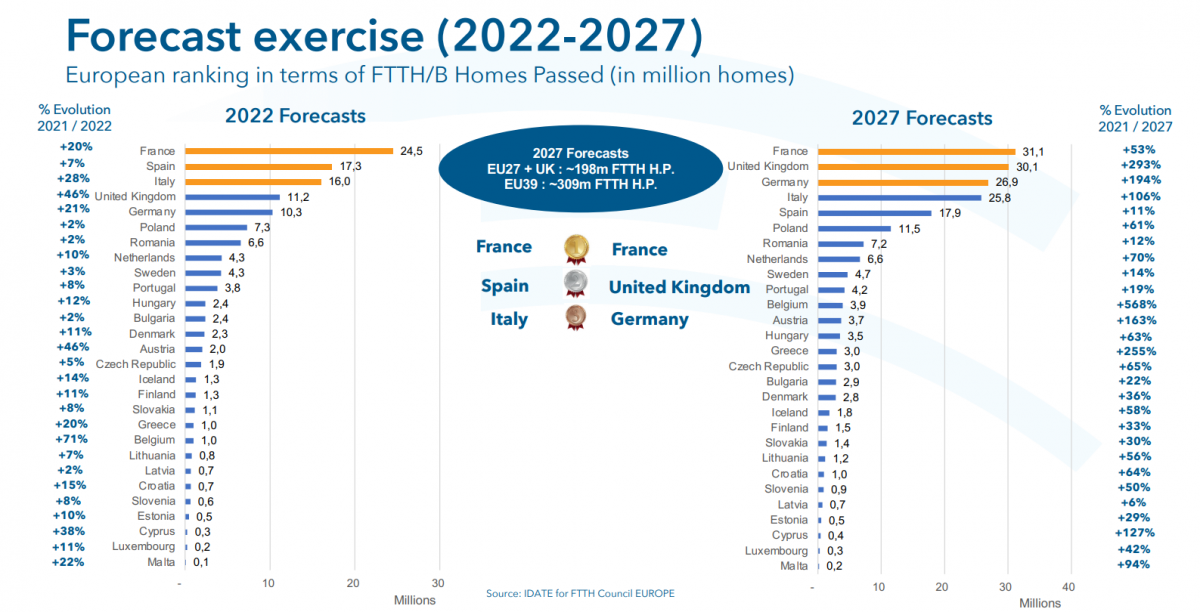

According to the council, the market forecasts are consistent with previous estimates and predict around 199 million homes passed for FTTH/B in 2027 in EU27+UK and 309 million homes passed in EU39 region. It is expected that the top three countries in terms of homes passed will be France (31.1 million), United Kingdom (30.1 million) and Germany (26.9 million).

The number of subscribers is predicted to reach 124 million in EU27+UK and 190 M in EU39 region, and the take-up rate will also experience steady growth in both regions, with the number of subscribers against homes passed expected to reach 62.2 per cent in EU27+UK and 61.4 per cent in EU 39.

Rural areas

The report shows that by September 2021, only 30 per cent of rural inhabitants could enjoy capabilities offered by full fibre connectivity (compared to the average number of 49 per cent of European households in the EU27+UK region that are covered by FTTH/B networks. The five countries with the highest rural FTTH/B coverage are Denmark (76 per cent), Latvia (74 per cent), Spain (66 per cent), Romania (62 per cent) and Luxembourg (55 per cent). The report highlights that immediate action should be oriented towards the rural regions to eliminate the ‘white spots’. It advised that an aggressive promotion and an intensified support (subsidies, public-private partnerships, etc.) of rural deployments should be carried out to reach every European premise with high-speed fibre-based broadband connectivity.

Eric Festraets, president of the FTTH Council Europe said: ‘The data from the latest Market Panorama confirms that fibre roll-out is steadily advancing at an increasingly faster pace. We can say with confidence that we are on the right track to meet the EU’s ambitious connectivity targets set out by ‘Gigabit Society 2025’ and ‘Digital Compass 2030’ strategies, yet the current momentum needs to be maintained and for this to happen the support at the political and regulatory level will be key. ‘

Vincent Garnier, director general of the FTTH Council Europe added: ‘The data clearly shows that we are achieving great progress in terms of fibre roll-out, thus contributing to the twin digital and green transition that will reshape how Europeans work, live and do business. The full fibre connectivity will be key to achieving the EU’s ambitious climate and sustainability targets. Moreover, the Covid 19 pandemic led to more data traffic and more demand, clearly demonstrating the necessity to intensify FTTH deployment and adoption.’

* EU39: EU27 countries + United Kingdom, 4 CIS countries (including Kazakhstan and Ukraine), and also Iceland, Israel, North Macedonia, Norway, Serbia, Switzerland and Turkey