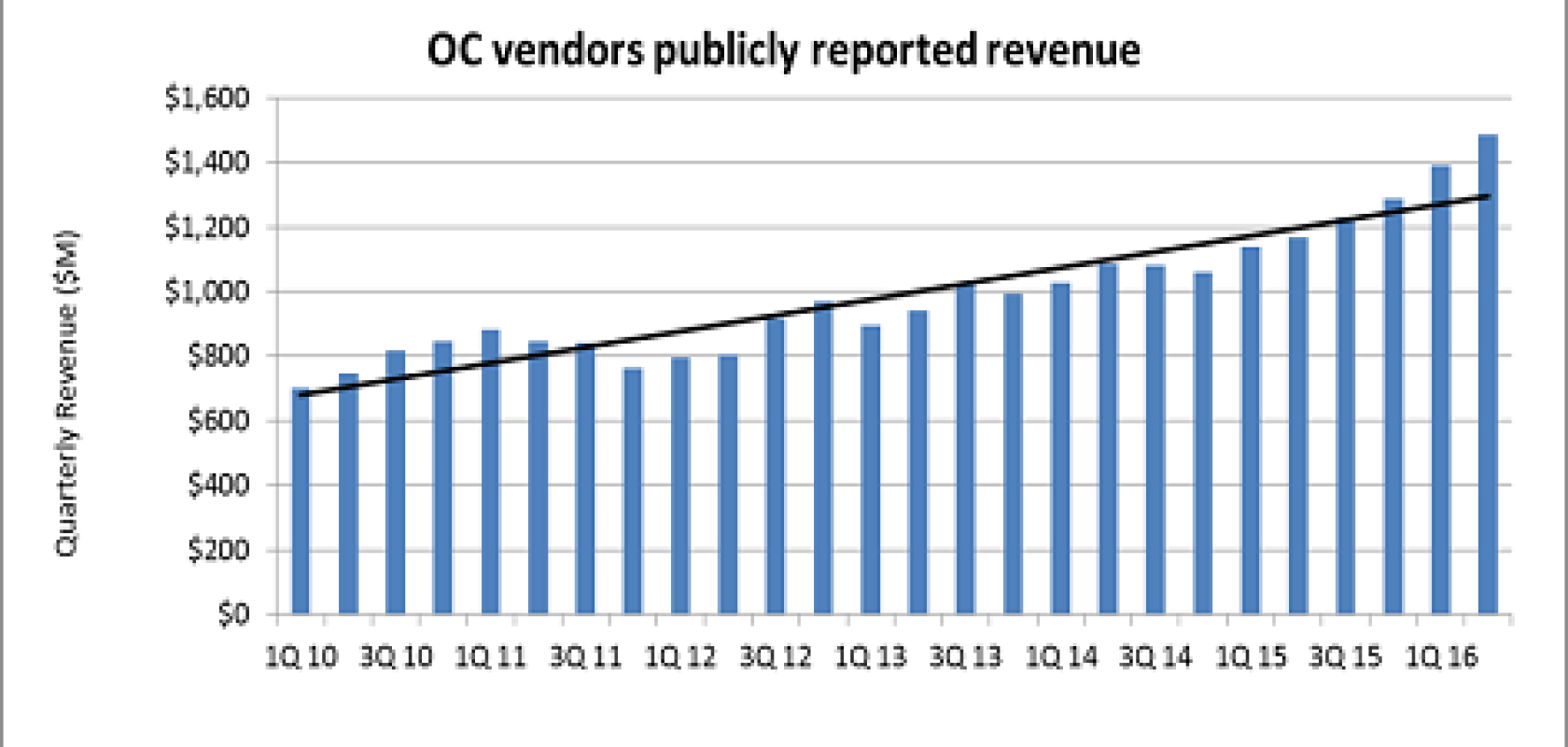

The combined revenues of the leading optical component vendors broke the $1.4 billion mark for the first time in the second quarter of 2016, an increase of 27 per cent compared to the year-ago quarter, according to the latest market report from analyst firm LightCounting.

Nine of the fourteen vendors tracked by LightCounting reported record revenues. Finisar, for example, last week reported a new company record for quarterly sales of $341.3 million, an increase of $22.5 million or 7.1% over the prior quarter, and its non-GAAP gross margins improved significantly to 33.1 per cent.

In Finisar’s case, the company said revenue growth was driven by strong demand for 100G transceivers across all types of form factor. According to LightCounting, many vendors said they benefitted from sales of 100G products of one type or another – from coherent optics (CFP-ACO, CFP-DCO, CFP2 and CFP4) to QSFP28 (CWDM and LR4) modules.

Across the optical components sector as a whole, a broad cross-section of market trends contributed to the revenue increase, including metro 100G in China, flexible-grid-based ROADM build outs in North America, and the unrelenting expansion of hyperscale data centre capacity.

Surprisingly, demand for technically mature 10G transceivers in XFP and SFP+ packages also showed very strong growth, LightCounting found. There was an especially large uptick in shipments of 40 and 80km-reach 10G devices, possibly due to the expansion of aggregation and edge metro networks in China.

Yet despite the stellar growth at the component level, telecom networking equipment sales increased at a more sedate 14 per cent, while data centre storage and switching gear sales continued to trend downwards, falling 5 per cent compared to the second quarter of 2015.

The disparity in growth rates between system and component vendors reflects the growing influence of white box system makers – which are not included in LightCounting’s reported datacom equipment figures – and increasingly common sales of components directly to end customers, the market research firm suggests.

Commenting on the report, Vladimir Kozlov said: ‘A key question for CEOs and their business planners is how long this surge in demand will continue. A number of vendors reported that popular product lines were capacity constrained in Q2, despite recent capital investments. In the past the component industry has fallen victim to ‘pipeline effects’, with demand multiplying as it moves down the supply chain, resulting in inventory corrections following large increases in demand. Today’s tighter coupling between component suppliers and end customers should lower the likelihood of this happening again or reduce its impact, but it remains a risk.’

LightCounting’s Quarterly Market Update Report also presents an analysis of revenue and spending trends of top-tier telecom and internet service providers, and the financial results of telecom and datacom equipment vendors, including the market shares of the leading suppliers of 100G DWDM transport equipment.