Industry research firm LightCounting has released its High-Speed Ethernet Optics report for March 2022.

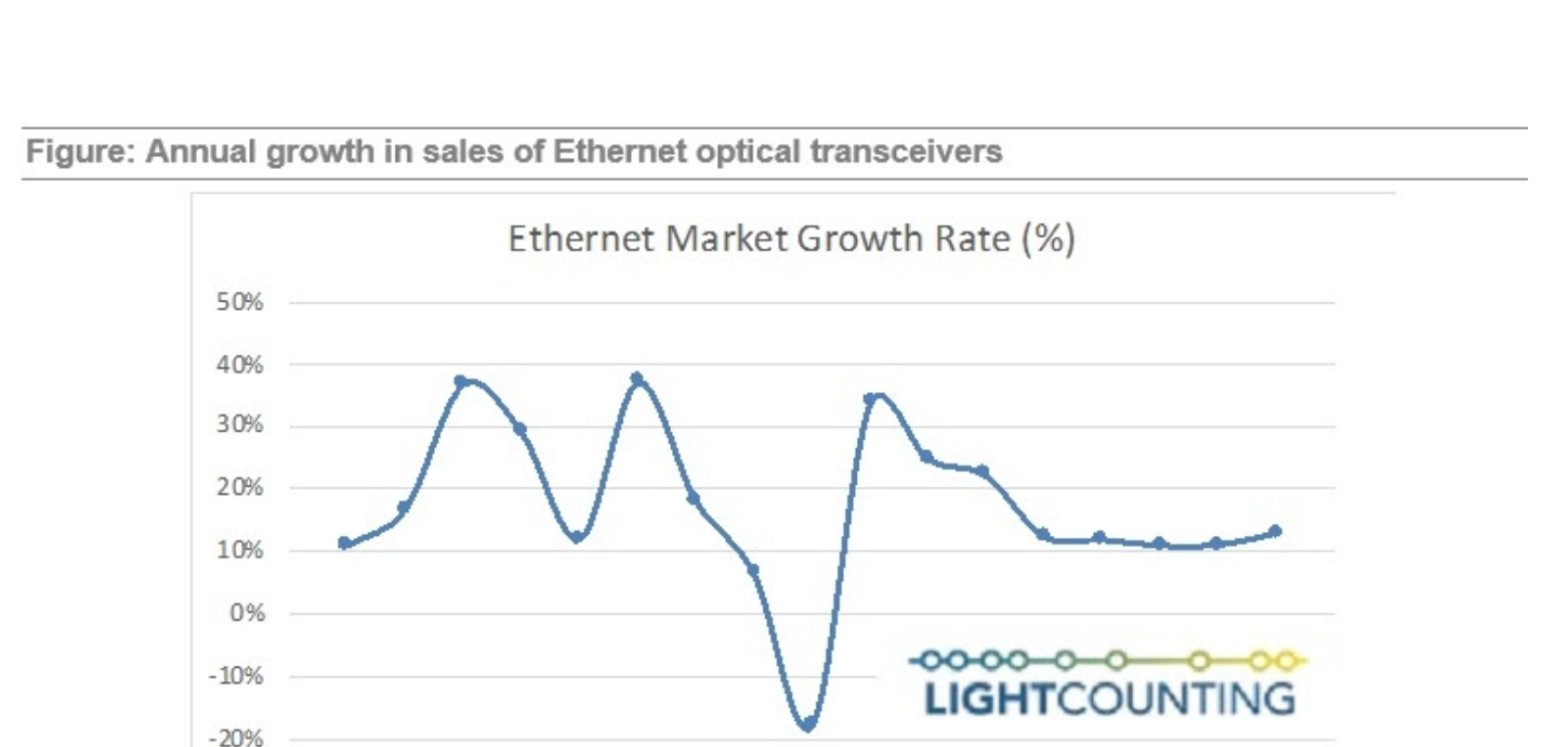

Amongst its findings was the news that sales of Ethernet optical transceivers managed to set a new record in 2021 reaching $4.6bn – a 25 per cent rise from 2020, when the market jumped by 32 per cent after a decline of 18 per cent in 2019.

The company said that it expects the growth rate to moderate to a 14 per cent CAGR in 2022-20207, but even at this modest growth, the market will reach $10bn by 2027. The firm warned that the market will remain volatile, and its long-term forecast model is not designed to predict the fluctuations but offer a reasonable five-year target for the industry.

In terms of growth drivers, the report highlighted that, suppliers of optics recovered within a few months from the disruptions caused by Covid-19 early in 2020, and demand for all products ranging from 1GbE to 400GbE exceeded expectations for the full year. This had an impact industry-side, said LIghtCounting, with sales of 1GbE transceivers picking up, alongside 10G and 40G products. Demand for legacy products started to decline at the end of 2020, but it picked up again in the first half of 2021, which was not expected. Most likely, said the report, this new and probably last wave of demand for legacy products came from upgrades in enterprise and telecom networks, which were delayed due to the pandemic.

The report cites a ‘more important factor driving the market growth’ as very strong demand for 200GbE and 400G transceivers. Google started deploying 400G modules three years ago, but Amazon started in 2020 and made an impact on the market. Meta delayed deployments of 200G until 2021, but LightCounting said it is certainly catching up on a couple of slow years now. The first sales of 2x400G transceivers to Google also made a contribution to the market growth in 2021.

This momentum is expected to continue in 2022, but the company projects slower growth in 2023-2027. The forecast model for this is based on assumptions for growth in bandwidth of Ethernet optical connectivity across numerous applications. Consumption of optics is measured separately for each one of the top 10 Cloud companies as well. For example, the company estimates that Amazon almost doubled the bandwidth of its datacenter networks in 2020 and in 2021, via massive upgrades to 400G connectivity. In the long term, LightCounting said that it expects the growth in bandwidth to moderate to 40 per cent per year or double roughly every two years.

The firm’s forecast for 800G and 1.6T products was also increased to allocate enough of these modules for supporting 40 per cent per year bandwidth growth in data centres operated by Google and Meta for 800G and Amazon and Microsoft for 1.6T transceivers.

In conclusion, the company cited a conservative forecast as a good reference point for the market prone to fluctuations as it helps to account for unexpected slowdowns in demand and economic recessions, acknowledging that the current economic and geopolitical situation is extremely volatile. ‘The pandemic was a net positive for our industry, which is unusual,’ said LightCounting. The Ethernet market posted 18 per cent CAGR in 2011-2021 with just one slow year and no recession. With this in mind, a 14 per cent CAGR for 2022-2027 is thought to be a reasonable assumption.