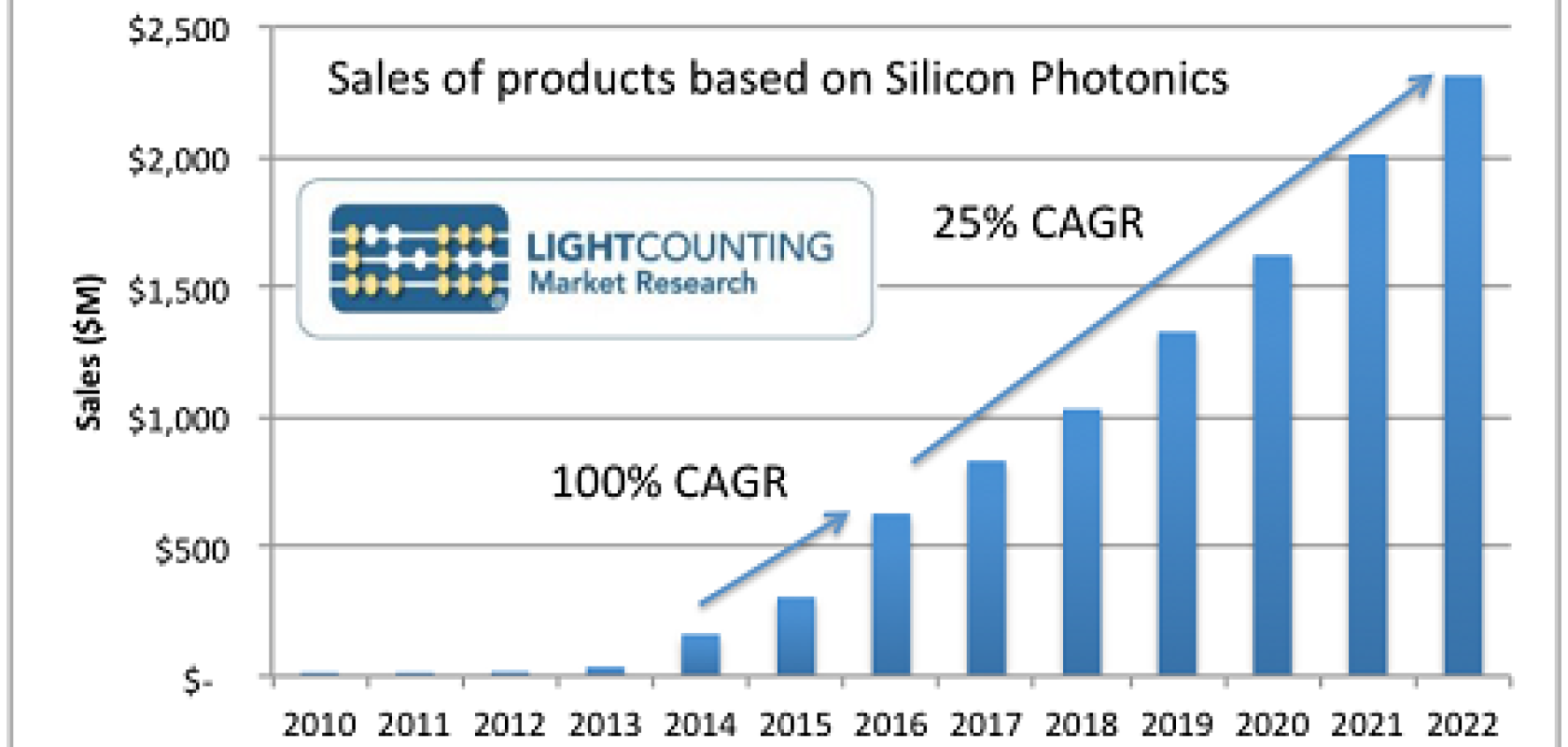

Revenues from silicon photonics-based optical transceivers doubled in 2016 compared to the previous year, to exceed $600 million. This doesn’t indicate a sudden market disruption, however; on the contrary, silicon photonics market share is expected to ramp gradually with sales of such products reaching $2 billion by 2022.

That’s the conclusion from analyst firm LightCounting, whose report ‘Integrated Optical Devices: Is Silicon Photonics a Disruptive Technology?’ examines the prospects for silicon photonics and forecasts the market growth over the next five years.

In 2016, silicon photonics' greatest successes were in the 40 and 100 Gigabit Ethernet and 100G DWDM transceiver markets, as optical module makers Acacia and Luxtera continued to ramp up production volumes and Intel entered the market (see First light for Intel’s silicon photonics transceivers).

In revenue terms, silicon photonics will account for more than 20 per cent of the global optical transceiver market by 2022. But with the market being mainly for high-end devices, the contribution of silicon photonics to the optical transceiver market in terms of number of units shipped will remain below 2.5 per cent of the total.

“The majority of these products will be high-end devices, operating at 100G or above and priced accordingly,” commented Vladimir Kozlov, founder and CEO of LightCounting. “This seems to contradict the expectations of many industry experts that silicon photonics will enable inexpensive, massively produced optical connectivity … However, if the main advantage of silicon photonics is integration, this technology is most suitable for complex high-end devices that require a lot of integration.”

In LightCounting’s view, most integrated products that combine one, two or four optical functions, such as those inside a single transmitter or receiver, will continue to rely on indium phosphide (InP) and gallium arsenide (GaAs) technologies for the next decade.

There is currently not a single silicon photonics-based product that does not have an alternative made using InP and GaAs materials, the analyst firm observes. Although many in the industry have predicted that silicon photonics will enable inexpensive, mass-produced optical components, LightCounting’s analysis suggests this will not happen in the next three to five years.

Only if silicon photonics can offer new functionality that cannot be achieved with existing materials, could it prove to be truly disruptive, the analyst firm says. Integrating optical connectivity with electronic chips may enable such new functionality. Adding silicon photonics-based optical switching or quantum computing to the mix could open a wide new frontier for innovation, but such dramatic market shifts are hard to predict.

Nevertheless, all established component and module suppliers have silicon photonics technology on their roadmap. “The chances for success of these efforts are real and no vendor can afford to ignore the possibility of a disruption,” Kozlov said. “Being prepared seems to be the only practical solution.”