The market for optical circuit switching (OCS) is now forecast to reach at least $2.5bn by 2029, according to market research firm Cignal AI. This projection represents an upward revision of approximately 40% compared to Cignal AI's initial January 2025 forecast, driven by new supplier data and an expanding set of live trials across multiple applications beyond the core hyperscalers.

Use cases expand beyond Google's original deployments

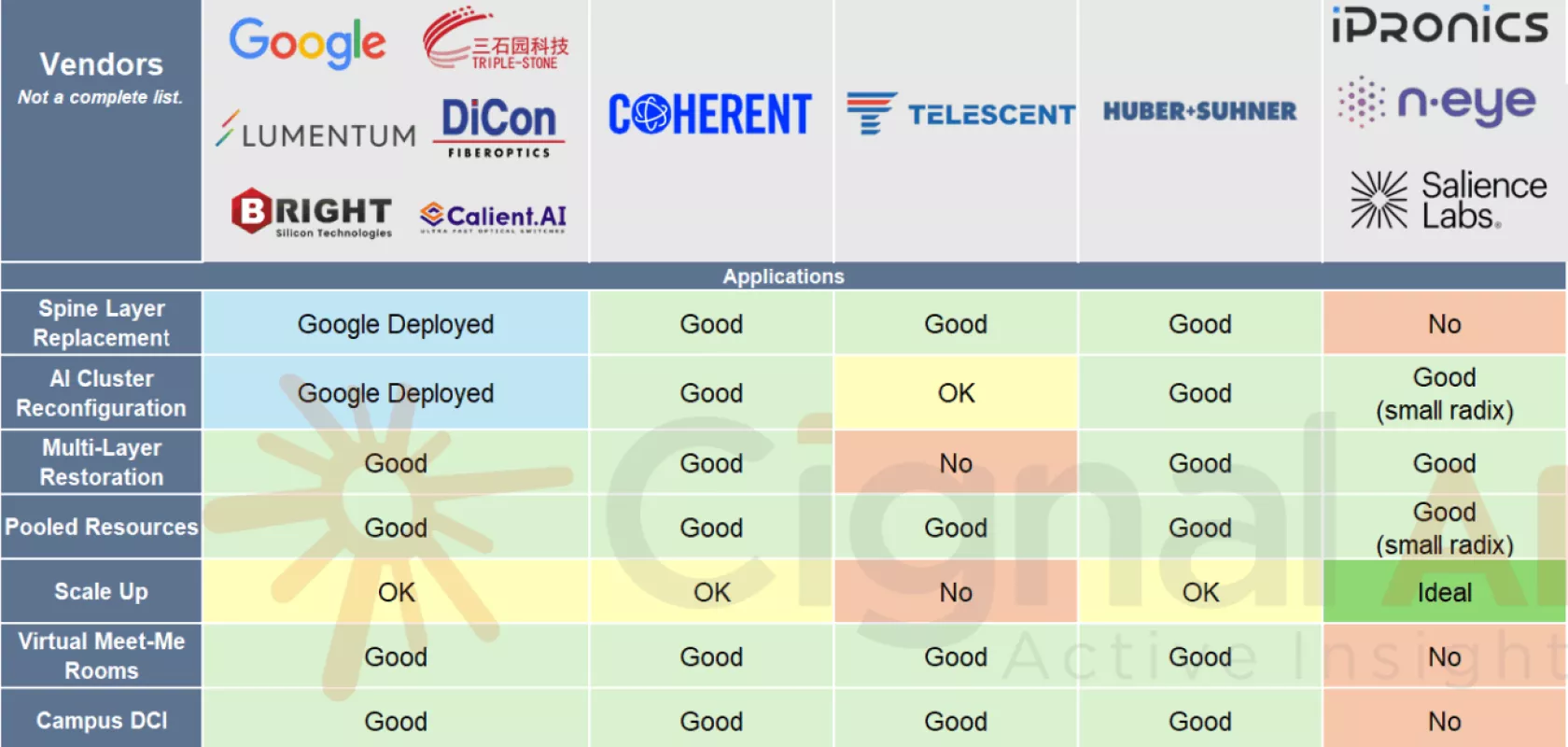

OCS applications inside data centres are diversifying significantly beyond Google's pioneering internal implementations. Operators are now deploying and evaluating OCS technology for scale-up and back-end networks, pooled and disaggregated resources, and campus data centre interconnect (DCI).

Reliability has emerged as the defining requirement for AI-class deployments. Multiple technology approaches are now competing to address different combinations of radix, speed, and loss, including: MEMS, liquid crystal, piezoelectric, robotic, and silicon photonics implementations.

"Over the past year, OCS in the data centre has expanded from a singular Google project to a multi-vendor market with real deployments, purchase orders, and a credible path to multi-billion-dollar annual sales," said Scott Wilkinson, lead analyst for optical components at Cignal AI.

Google migration creates commercial opportunity

Google has deployed tens of thousands of OCS ports for spine-layer replacement and AI cluster reconfiguration using internally developed systems. The hyperscaler is now beginning to migrate to commercial solutions, opening a multi-hundred-million-dollar opportunity for external suppliers.

Lumentum has provided public guidance indicating OCS revenue of approximately $100 million per quarter by the end of 2026, suggesting the company could account for around half the OCS market next year if current trajectories continue.

OCS shifts datacom transceiver requirements

The report details critical implications for datacom transceiver technology. The need for OCS-interworked optics is driving requirements for extended span budgets (up to approximately 6km for FR optics), bi-directional operation using circulators, and a significant likely market shift from DR to FR formats. This market shift inherently favours InP-based optics over silicon photonics DR implementations.

Cignal AI's analysis covers more than 20 suppliers including Coherent, Lumentum, Huber+Suhner, Telescent, iPronics, DiCon, Triple-Stone, Calient, and Drut.

"The revised forecast, the number of active vendors, and the breadth of operator evaluations make it clear that optical circuit switching will be a foundational technology for large-scale AI systems rather than a niche option," Wilkinson concluded.