Cartographers once drew dragons, sea serpents and other mythological creatures in uncharted areas of their maps, illustrating their anxiety about the unknown. Technologists are made of sterner stuff. When entering uncharted territory, they use roadmaps to navigate through calm waters towards common objectives.

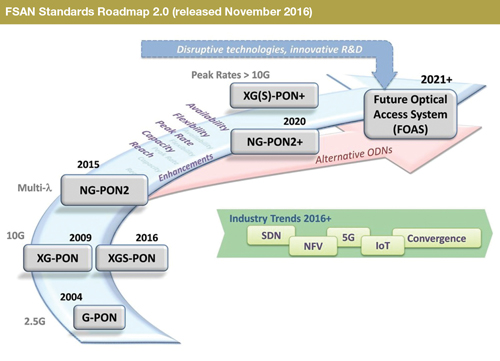

For 20 years, the Full Service Access Network (FSAN) group has guided the development of passive optical networks (PON) by building consensus on the best approach, before their ideas are passed over to the ITU for standardisation. They had a roadmap, but it came to an end in 2015.

‘The group was at a point where we were falling off the edge of the world,’ commented Peter Dawes, co-chair of the Next Generation PON Task Group at FSAN. ‘We were off the edge of the map and it was time to think about the next 10 years.’

Roadmap review

The FSAN group had achieved everything they set out to achieve with their previous roadmap. It culminated in the approval in October 2015 of ITU Recommendation G.989 for ‘40-Gigabit-capable passive optical networks (NG-PON2)’. This technology is the first to use multiple wavelength pairs in the access network, and increases capacity four times compared to the previous technology generation. It does this by overlaying additional 10Gb/s wavelengths on the optical distribution network. A later amendment increased the number of possible wavelengths to eight.

This was followed in December 2016 by first stage approval for G.9807.1 for ‘10-Gigabit-capable symmetric passive optical network (XGS-PON)’, a related technology that also provides 10Gb/s capacity on a single wavelength, but takes advantage of lower-cost, fixed-wavelength optics rather than using the tunable transmitters required for NG-PON2.

These latest technologies are in the early stages of deployment in commercial networks. Verizon, for one, is currently evaluating vendors for a roll-out of NG-PON2 technology across its access network, including to its FiOS customers. It has just completed what is believed to be the first demonstration of interoperability between NG-PON2 equipment from different vendors. But while service providers are still kicking the tyres on the new technology, they are already discussing what comes after that.

‘FSAN is an operator-driven group,’ explained Dawes. Out of about 70 member companies, 26 of them represent the world’s biggest telecom operators, including AT&T, China Mobile, NTT, Verizon, and Vodafone. In a series of meetings over the course of a year, FSAN members discussed the creation of the new roadmap. ‘The first time we discussed it was December [2015], so that was a year ago,’ recalled Dawes. ‘It was a fairly long process and we went through several iterations before we arrived at the roadmap that you see now.’

The need for speed

One thing that came out of those discussions, certainly for the first part of the roadmap until 2020, was the realisation that everyone is looking for an evolution to the recently standardised technologies. ‘It’s not a case of working on a brand-new technology straight away,’ Dawes remarked. ‘It’s more a case of making the existing technologies a commercial success, and building on those standards … rather than taking a shift into a whole new principle of operation,’ he said. Verizon’s interoperability trial is a case in point.

While the majority of fibre-to-the-home (FTTH) networks around the world are based upon PON technology, residential services are no longer the main driver for their development. ‘The mass market is very well served by GPON,’ observed Derek Nesset, co-chair of FSAN’s Next Generation PON Task Group. While operators in some of the more mature FTTH markets are looking to move to next-generation technologies sooner, it is likely that only the ‘power users’ on those networks would opt for the higher broadband speeds they provide. In its market forecast released in 2016, Ovum estimates that the number of GPON optical line terminal (OLT) ports shipped in 2021 will be 10 times the volume of all other ITU-T type next-generation PON ports combined.

‘This does not mean there will be no meaningful market for next-generation PON systems,’ he added. ‘However, any future roadmap must take into account the wider market beyond residential services, such as business leased line services or mobile backhaul and fronthaul applications.’ Operators expect to increase their revenues by mixing residential and business users or mobile cell sites on a common access infrastructure. NG-PON2 systems were already designed with such converged services in mind, but business and mobile service requirements continue to evolve.

Whereas 100Mb/s services were common among small to medium enterprises, Gigabit Ethernet services are becoming increasingly popular. ‘Typically, business users expect their services to provide symmetric bandwidth, and this was a strong motivation behind the recent standardisation in the ITU-T of XGS-PON,’ Nesset said. ‘Revenues from such premium services may be sufficient to justify the higher cost of next-generation systems.’

Mobile fronthaul – connecting remote radio heads to the baseband equipment – has also been a hot topic of discussion among FSAN members for several years. ‘Certain Asian operators are very interested in converging mobile traffic onto their PON network … because they have a high volume of deployed fibre in the access, so it makes sense to reuse it for those kinds of applications,’ explained Dawes. The transport of mobile fronthaul was a key motivation behind the specification of point-to-point wavelengths in addition to the time-division (TDM) based channels in the NG-PON2 standard. In future, mobile fronthaul could be packet-based, and so could be transported on sufficiently high-capacity TDM channels in a PON.

Roadmap themes

The new roadmap highlights peak rates to individual end users of greater than 10Gb/s, to serve business customers and mobile operators. There are several ways to approach this goal, according to Dawes. ‘The next steps could be increasing the bit rate on wavelengths that are already defined, adding some more wavelengths or bonding wavelengths that are already there to give bigger single peak rates or capacity,’ he explained.

The standards development process can take advantage of efforts in other parts of the optical industry to develop faster and lower cost optical technologies, particularly within Ethernet. For example, the IEEE P802.3ca 100G-EPON Task Force, which began work in December 2015, is currently working on a model for 25G operation over a single wavelength (with four wavelengths yielding an aggregate capacity of 100Gb/s).

Historically, ITU-T standards-based PON bit rates have advanced in multiples of 2.5, so a step from 10G to 25G operation seems logical. Right now, however, all options are still open. ‘We’re not necessarily going to 25G straight away,’ Dawes said. ‘It may even be that we look at just a small step from 10G to 12.5G or 15G. It’s going to be partly driven by what components are available and what we can do with different modulation schemes … things of that sort.’

Purely increasing the bit rates and capacity are not the only consideration in the evolution of optical access standards, however. Operator requirements that have been broadly agreed appear on the roadmap under five themes: availability, flexibility, peak rate, capacity and reach. Protection and resilience, in particular, are going to become increasingly important, given that next-generation PONs will be expected to carry high-value services such as business and mobile traffic. Even residential fibre services that carry premium TV and video content are candidates for better service availability, Nesset points out. One mechanism to improve service availability is to automate fault diagnostics, for example through monitoring with embedded optical time-domain reflectometers (OTDR). Such schemes are possible, but the underlying technology needs further development and cost reduction before it can be deployed more widely.

Blazing new trails

Backwards compatibility has been an important element of PON development. ‘There are certain rules, even in the distant future, one of the main ones being that service providers can use their existing fibre in the ground – the optical distribution network as it is now in terms of power budget, splitting ratio and so on. I wouldn’t expect that to change,’ said Dawes. All the standards developed to date, including GPON, XGS-PON, and NG-PON2, must work on a power splitter-based optical distribution network (ODN). Power splitters are passive devices that broadcast the signal to all end points. This architecture is very fibre efficient: a single feeder fibre is used to connect a central office to the local service area where a power splitter shares out the signal.

There is acknowledgement, however, that beyond a certain date a more radical approach may be needed. ‘We are running out of technical levers that enable higher PON capacity, while needing to support ODN losses up to 35dB, and lower loss ODN types could be attractive,’ Nesset commented. Thus, there is a parallel path on the roadmap that the group calls ‘alternative ODNs’. Under consideration is whether it would make sense, for certain applications, to replace the power-splitter-based architecture with a wavelength-selective ODN. Wavelength splitters can be used with the same basic tree and branch network topology. But unlike power splitters, wavelength-selective devices route individual wavelengths to specific destinations. This lifts the power budget constraints, but would require more expensive optical components.

Other major industry trends that will certainly impact the roadmap – in ways that are not yet clear – include software-defined networking (SDN), network functions virtualisation (NFV), and the Internet of Things (IoT). When it comes to the IoT, for instance, there may be aspects of network management that need to be considered when collecting data from a high number of low-bandwidth end points. Rapid service activation by open source software running on commodity hardware are promising candidates to save money – both capex and opex – though it remains to be seen whether, and when, the expected benefits will materialise.

The PON Standards Roadmap 2.0 is available from the FSAN website.