According to the latest report – Market for Optics in China – by LightCounting, the last decade has seen China exhibit a greater impact on the global optical communications industry than any other nation.

The bulk of fibre to the home (FTTH) projects in China have been completed and the FTTH program is moving from initial large-scale deployments to slow but steady upgrades. What’s more, there are one billion 4G subscribers in China eagerly awaiting 5G wireless systems. Demand for optics required by these projects is picking up and will be red hot by 2020. Huawei will continue to lead in deployments of DWDM systems, says the optical analyst firm, but most of the optics for these systems will be made internally, including pluggable transponders.

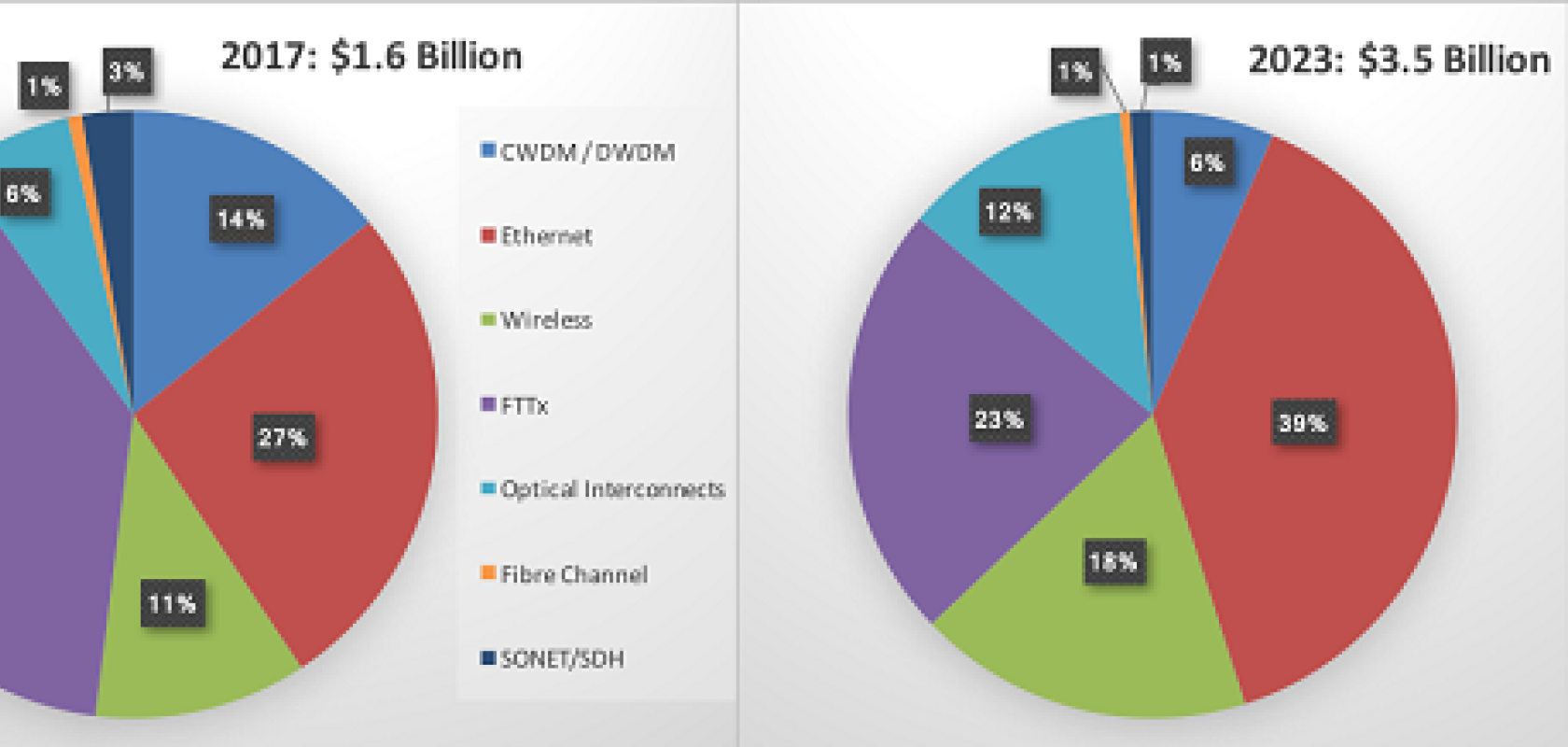

The report also points to upgrades of Cloud datacentres in China to 100GbE connectivity just starting, and states that these projects will have the most impact on sales of networking equipment, optical components and modules deployed in China over the next five years. Consumption of Ethernet optics is projected to grow rapidly in 2018-2023, accounting for the largest share of the total sales of optics to China by 2023. Demand for optical interconnects, such as active optical cable (AOCs), is also expected to remain very strong.

According to the report, infrastructure investments by China’s top three ICPs – Alibaba, Baidu and Tencent – are five times smaller in dollars compared to the spending of Amazon, Google and Facebook, but the Chinese investments are growing faster and there are a number of barriers for foreign companies to operate in China’s cyberspace. However, IBM partnered with 21Vianet and Dailian Wanda to build cloud datacentres in China. Additionally, Amazon Web Services are now offered by Sinnet Technology and Ningxia Western Cloud Data Technology Co. Ltd in China. Apple is also working with a local partner, supporting its cloud services.

The presence of Western competitors is driving competition in datacentre technology, leading Chinese ICPs to begin upgrading servers, switches and the connections between them to the latest 100GbE technology. If one upgrades, all the others follow.

Amongst other topics covered in the report are current and future infrastructure projects of Communication Service Providers (CSPs) and Internet Content Providers (ICPs) in China. The report analyses the impact of these projects on the demand for optical networking equipment, optical modules and components. Also included are profiles of the leading Chinese CSPs, ICPs, equipment manufacturers and suppliers of optical component and modules. A detailed companion spreadsheet accompanies the report, containing a detailed five-year forecast of shipments and revenues of optical component demand in China.