Specialist industry market research firm Cignal AI has released its Transport Hardware Report Worldwide for the second quarter of 2021.

According to the report, spending on network transport equipment declined 5 per cent during the period. Chinese network operator spending collapsed more than 20% in 2Q21 as 5G capex paused and supply chain challenges worsened. North American results were weak year-on-year due to cyclical Covid influences in 2020. However, said the report, operators in the region are set to ‘grow spending aggressively’ in the second half of the year.

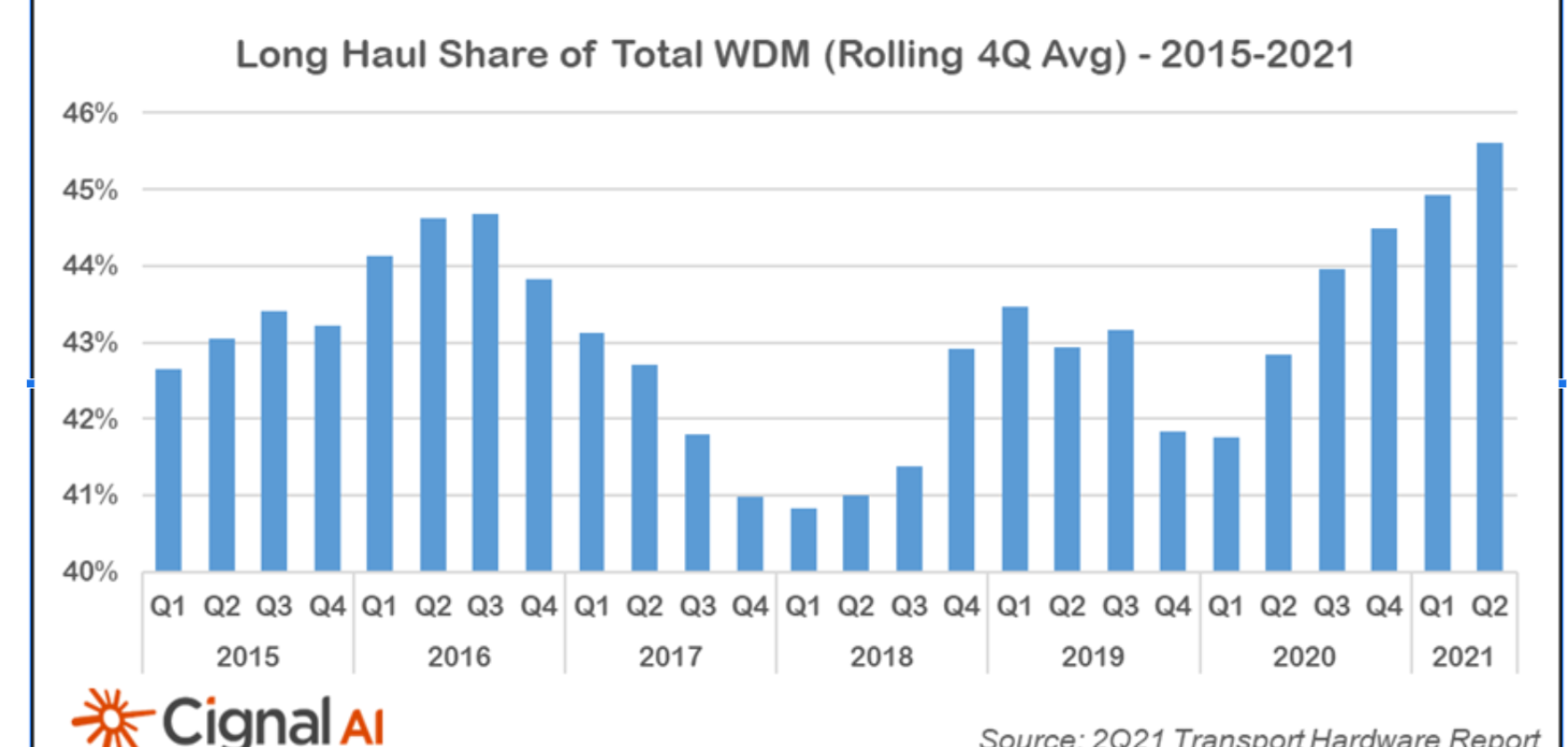

Amongst other findings, the report also revealed that the spending mix between long-haul and metro WDM reached a record level following five quarters of investment in advanced coherent and line system technology. Carriers may be deferring metro expenditures considering the imminent availability of transport system upgrades using 400G coherent pluggables.

Chinese optical and packet hardware spending collapsed, resulting in the largest single quarterly decline on record and the first instance of consecutive quarters with year-on-year declines. But sales of optical hardware in the EMEA region were up significantly year-on-year as the region continues to produce steady single-digit growth. Despite strategic wins by Nokia, said the report, and observations of increasing replacement activity from Ciena, Huawei’s footprint in EMEA shows no noticeable impact from geopolitical factors.

North American packet transport sales were up slightly, with market leader Cisco gaining in Core as its 8000 series routers ramp. Component shortages weighed on smaller equipment manufacturers as constrained global semiconductor production increased lead times. ADVA and Infinera quantified the effect on sales (10 per cent and 6 per cent of revenue, respectively), though larger vendors reported minimal impact on their sales. Vendors do not anticipate resolution of these issues until 2022.

Kyle Hollasch, lead analyst for transport hardware at Cignal AI said: ‘Despite current semiconductor supply chain issues, North American spending should accelerate in the second half of 2021 as operators purchase additional high-performance long-haul WDM coherent equipment. Long Haul line systems capable of supporting wider and variable channel spacing, higher degree counts, and improved add/drop capabilities provide compelling reasons to make investments now.’