Cignal AI has released its Optical Applications Report for the third quarter of 2018, which details a healthy growth of coherent 200G shipments during the period, even slowing the adoption of lower 100G speeds.

The Optical Applications Report details market share for the third quarter of 2018, providing forecasts in three key markets: compact modular equipment; advanced packet-OTN switching hardware; and 100G+ coherent WDM port shipments across multiple speeds. Issued quarterly, the latest iteration of the report also finds that pluggable 200G CFP and CFP2-DCO solutions will help the market expand even further in 2019, despite the anticipated widespread introduction of 400G coherent in the first half of 2019.

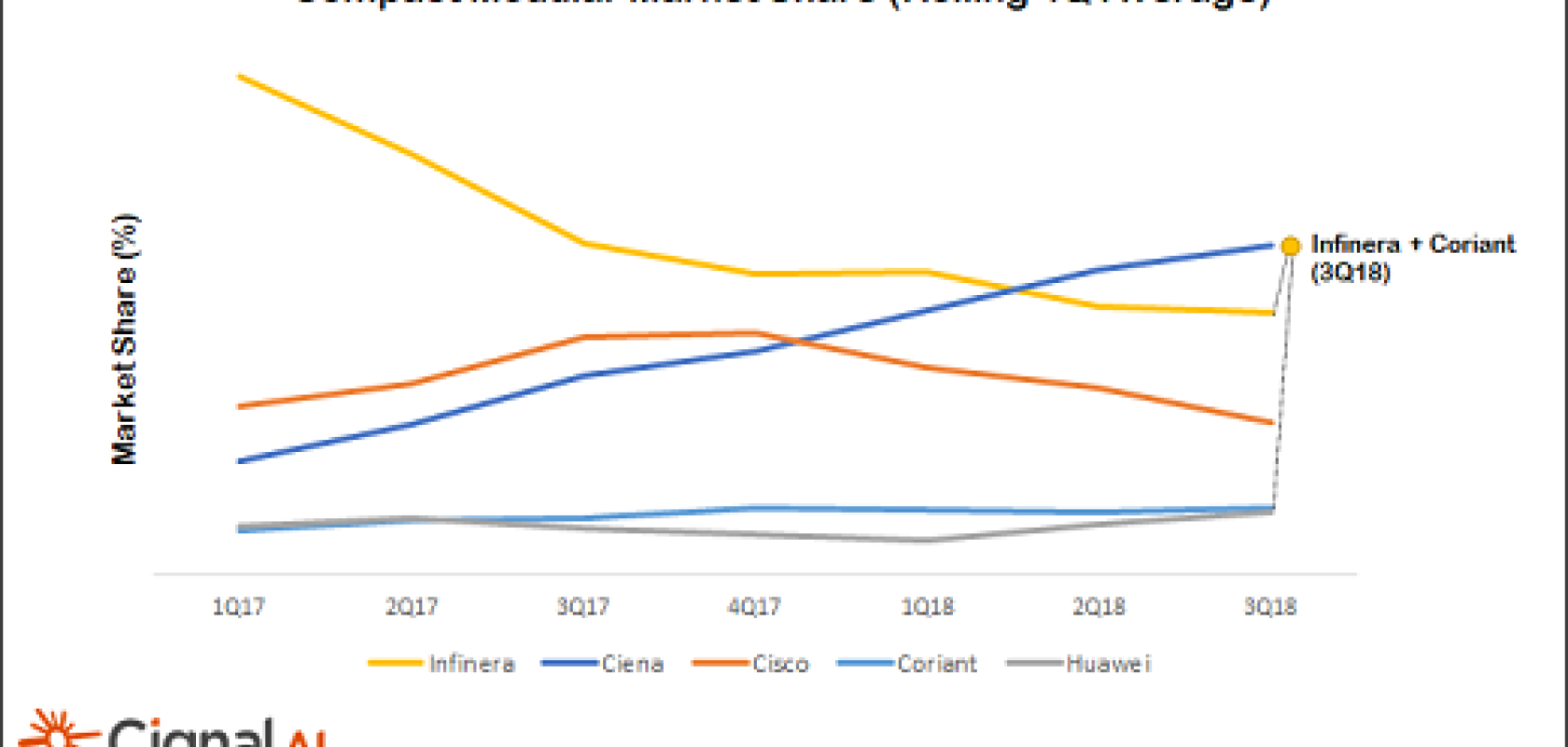

Looking at market share numbers, the report finds that the combination of Infinera and Coriant could be well placed to challenge Ciena. This category measures hardware designed specifically for use in DCI and open disaggregated hardware applications and it is tracking to exceed $1 billion in revenue this year. Explained Scott Wilkinson, lead optical analyst for Cignal AI: ‘Compact modular equipment sales grew in all markets in the third quarter, and APAC was especially strong. Ciena continues to lead the market, but the combined Infinera plus Coriant may prove to be a challenging competitor if it can re-establish technical leadership at 400G.’

Amongst other findings, the report states that 400ZR is on track for introduction in 2019. Research and development momentum is building among component and equipment makers, with total industry spend in excess of $300 million.

Cignal AI’s data additionally finds that compact modular is expected to be a higher percentage of the North American market, where sales rose again due to strong purchasing from the cloud network operators, even as the region’s overall optical market declined in the third quarter. Compact modular now represents more than a quarter of all optical sales in North America as adoption outside of DCI applications expands. Packet-OTN market growth, meanwhile, continues outside of North America. Led by incumbent builds in Asia and Europe, sales grew by more than 30 per cent worldwide. Packet-OTN continues to be a core technology of choice for traditional network operators in those regions.