Optical analyst firm LightCounting has released its latest report covering high speed Ethernet optics, which found that, while 2019 may prove to be a flat year, sales of Ethernet transceivers will improve for the period 2020-2024.

The High-Speed Ethernet Optics report contains more than 50 product categories, with a summary of technical challenges faced by high-speed transceiver suppliers, including a review of the latest products and technologies introduced by leading suppliers, and a forecast to 2024. It is based on confidential sales information, as well as analysis of publicly available data from leading component and equipment manufacturers, and input from industry experts.

According to the latest report, the industry is experiencing an exciting time. Shipments of 100GbE modules exceeded 7 million units in 2018, deployments of new 2x200GbE products have already started, and the first volume shipments of 4x100GbE DR4 (400G-DR4) transceivers are about to start.

However, said LightCounting, ‘it does not feel like a party for suppliers.’ This is attributed to a struggle amongst vendors to maintain profitability, following continued price decline in 2018. Some of the 100GbE demand disappeared in the second half of 2018, said the report, because buyers had problems with inventory build-up. The development of new products requires a lot of investment, and customers may be reluctant to purchase these modules until the pricing is ‘right.’ All options are on the table for the next round of upgrades: continue with 100GbE, switch to 200GbE, 2x200GbE and 4x100GbE with breakouts.

LightCounting said that it expects demand for 2x200GbE transceivers to peak in 2022, as Google starts to transition to 2x400GbE modules. The forecast for 400GbE includes 4x100GbE DR4 modules selected by Amazon. These will be deployed in a breakout configuration with DR1 modules on the opposite side of the link. Effectively, each fibre will be carrying 100GbE traffic, aggregated into a DR4 module on one side. Deployments of true 400GbE transceivers will be limited in 2019-2021 to upper levels of switching in mega-data centres and core routers. Implementation of high-radix configurations in leaf and spine networks using 400GbE connectivity will be challenging until switching ASICs reach 51Tb/s capacity, probably by 2022-2023.

Facebook has stated its intent to stay with 100GbE optics for now and use 200GbE or 400GbE transceivers in the next upgrade cycle in 2021-2022. Its new F16 data centre network architecture, will require up to four-times more optical connections compared to its previous design (F4). The first implementation of F16 topology will rely on 100GbE CWDM4 transceivers, boosting demand for these modules in 2020-2022. Facebook is already the largest consumer of 100GbE CWDM4 modules. It uses a sub-spec version of CWDM4 transceivers with 500m reach instead of 2km, also known as CWDM4-OCP (for Open Compute Project). The latest forecast database includes sub-spec CWDM4 modules as a separate category.

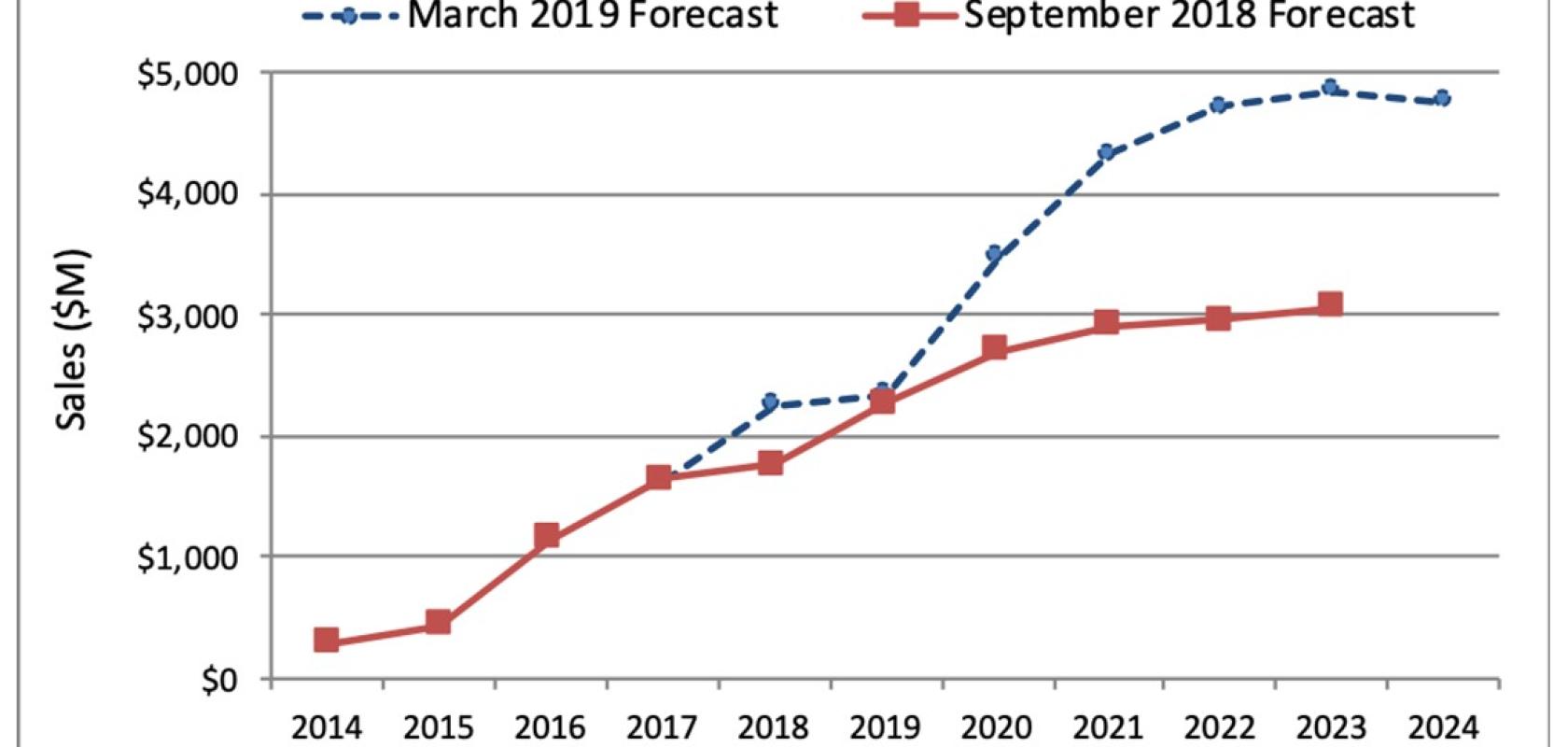

Figure 2 shows the changes in LightCounting’s forecast for all 100GbE optical transceivers, comparing data published in September 2018 with the latest forecast (March 2019). The revision upward of 2018 sales is mostly related to separation of sub-spec CWDM4 transceivers from the full spec version, adjusting pricing for these products and adding volumes to account for new suppliers of 100GbE products that are not yet sharing sales data. Facebook’s latest F16 network design and plan to continue using 100GbE connectivity resulted in an upward revision of the forecast for 100G CWDM4-OCP modules, boosting projections for the total sales of 100GbE transceivers in 2020-2024.

The bad news, said LightCounting, is that the 2019 outlook is pretty flat. Several suppliers reported slower than expected sales of 100GbE products in the second half of last year and it seems that this will extend into the first half of 2019. This softness is most likely related to limited supply of 12.8Tb ASIC chips such as the Tomahawk 3, which Facebook is using in its new Minipack switches. Once these issues are resolved, the demand for CWDM4 is expected to skyrocket in the second half of 2019 and make a real difference to the market in 2020-2022. Sales of sub-spec CWDM4 modules are projected to peak in 2022, as Facebook starts transition to 200GbE connectivity.

The revised forecast for sub-spec CWDM4 transceivers added an extra $1.2 billion to the total sales of 100GbE products in 2023. Increased projections for DR1 modules, used in combination with DR4, added another $680 million to the 2023 forecast.