Optical analyst firm LightCounting has soothing words for optical investors: don’t panic, optical component and module sales in 2017 will be just fine.

Though several suppliers of components and modules guided for lower revenues in the first quarter of 2017, raising concerns of a potential market downturn, LightCounting says its analysis suggests that these concerns are not justified.

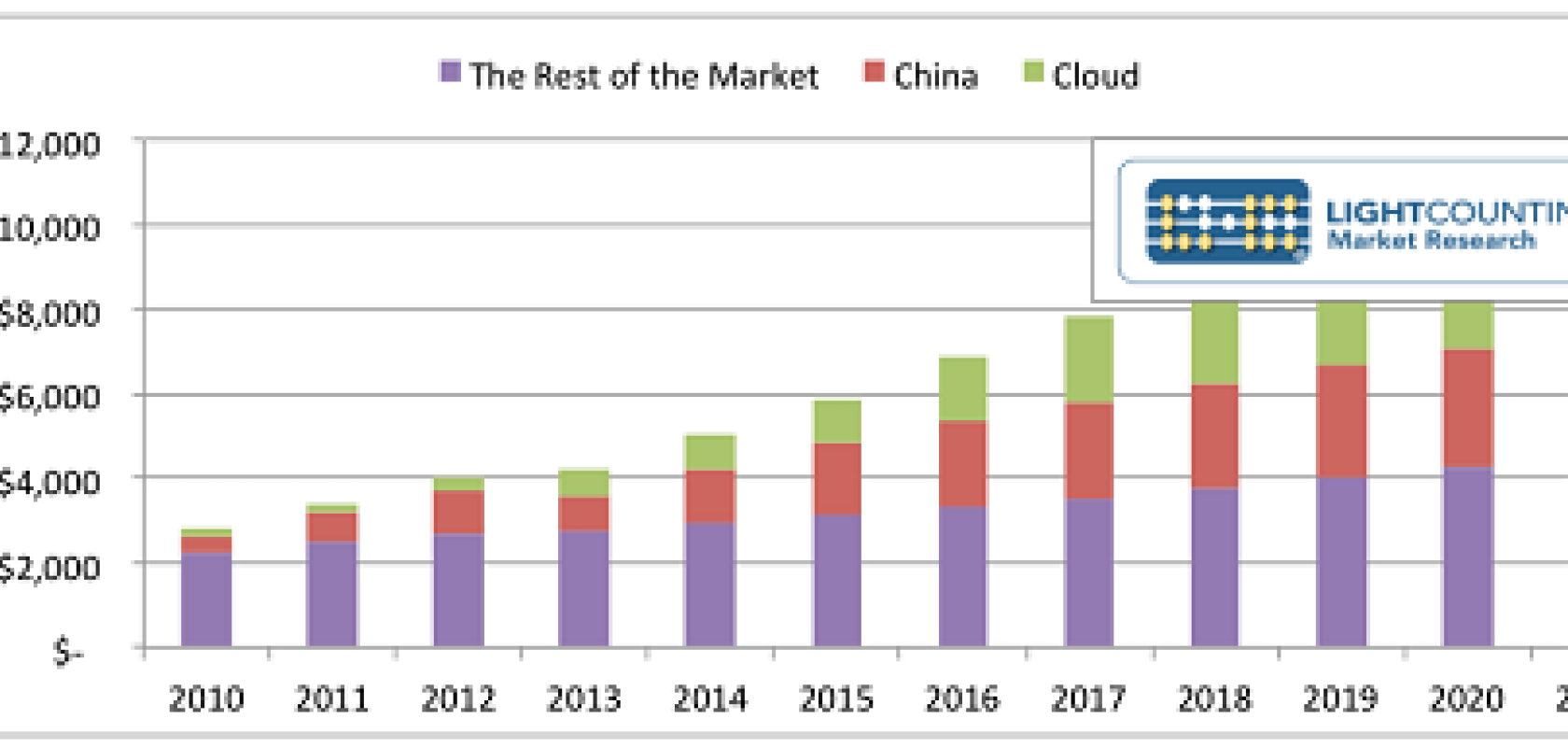

The year 2016 was a tough act to follow, with demand for optics at record levels. Though there have been some market wobbles, the underlying demand remains strong, the analyst firm reports. LightCounting sees no reason to revise its projections for 2017, published in October 2016 (see Demand for optics ‘at an all-time high’, reports LightCounting).

“Seasonally weak Q1 demand for optics in China, combined with a few glitches in production at Finisar and NeoPhotonics as well as lower demand from one customer of Acacia do not derail our outlook for the market in 2017,” the analyst firm commented.

LightCounting expects demand for optics to stabilise in 2017. Deployments of 100 Gigabit Ethernet (GbE) optics in mega data centres will contribute the most to market growth in 2017, while the broader market will hold steady.

Internet content providers are the main purchasers of 100GbE optics and high-speed optics remains a priority for them (see LightCounting: 100GbE optics sales exceeded $1B in 2016). Internet companies spent 25 per cent more in the second half of 2016 compared with the same period in 2015, and this trend should continue, the analyst firm believes.

LightCounting predicts that these customers will purchase more than one million units of 100GbE optics in 2017 – similar to the number of 40GbE transceivers sold in 2015. Shipments of many new 100GbE transceivers will double and triple in 2017, while legacy products, such as CFP LR4, are expected to hold steady.

On the telecom side of the market, AT&T and Verizon guided for modest increases in capex for 2017, which includes funding for deployments of ROADMs, 100G DWDM and trials of 400G DWDM products. LightCounting also expects Chinese service providers to maintain their investments in optical networks, and follow the lead of AT&T and Verizon in deployments of next-generation technologies.

As a result, shipments of 100G DWDM ports, which increased by more than 50 per cent in 2016, are projected to increase by 30 per cent in 2017 – a more modest, but still very healthy growth rate.

The transition in 100G DWDM deployments from long haul to metro networks that started in 2016 will continue. Ciena, Infinera, and Huawei reported increases in 100G ports shipped into metro applications in the second half of 2016. Pricing of optics used in metro applications is lower, however, so 30 per cent growth in the number of ports shipped will probably translate to 5–10 per cent growth in revenues for equipment suppliers.

These data come from LightCounting’s latest quarterly database and market update, which includes historical data on quarterly shipments and pricing of more than 100 products in Ethernet, CWDM/DWDM, SONET/SDH, Fibre Channel, FTTx, wireless fronthaul, EOM and AOC market segments. LightCounting will use this data to update its forecast for the Ethernet transceiver market, which will be released on March 31st along with a new report titled “High-Speed Ethernet Optics”.