In 2020, video calls have become ubiquitous thanks to Covid-19, revealing many people’s ‘lousy home broadband’, according to Geoff Bennett, director, solutions and technology, at Infinera. Bennett noted that unreliable video reveals the challenges facing optical communication technology serving metropolitan, or metro, areas.

Metro generally is not stressed for fibre capacity, he noted. But he includes data centre interconnect (DCI) for hyperscale internet content providers in this market, noting that they lease fibre from carrier companies to support ‘massive bandwidth requirements’.

‘Fibre is literally everywhere, and bandwidth is shooting up,’ Bennett’s colleague Rob Shore, senior vice president at Infinera, added. Introducing wavelength division multiplexing (WDM) and reconfigurable optical add drop multiplexers (ROADMs) ‘dramatically transformed metro networks 10 to 12 years ago’, he added. Having also evolved to embrace coherent modulation, metro is changing further thanks to 5G and distributed access architectures (DAA), Shore said. ‘We’re seeing a transition to 25G and 100G to the edge, and 400 to 800G in the metro core per wavelength.’

Karl Gass, vice chair of the optical track of the Optical Internetworking Forum’s Physical and Link Layer Working Group noted that metro networks are described as spanning from anywhere between 20 to 800km. He added that data centres have been ahead of carriers on cost. ‘There has always been that look of envy from telecom operators on howcheap datacom equipment could become,’ Gass observed. Metro networks have therefore seen adoption of WDM to lower costs.

Alternative technology

As metro networks transform in line with 2020’s trends, some are now increasingly looking to other technologies pioneered in datacom, such as pluggable modules. Others are also looking to expand the light spectrum carried by fibres – but they are considering a wide range of approaches.

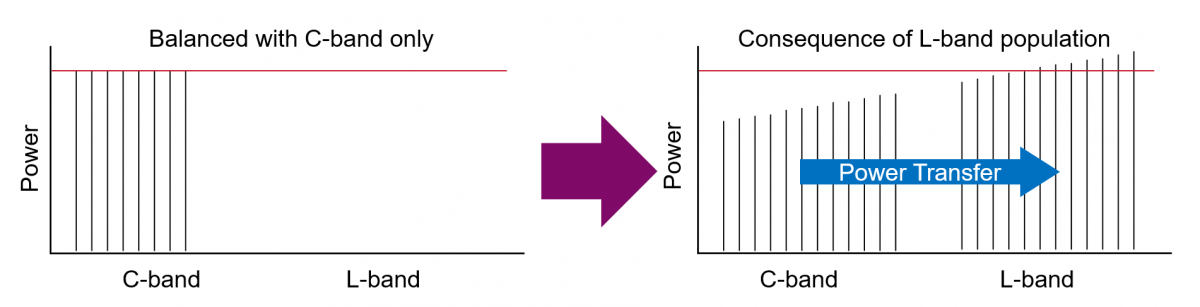

WDM is ‘the easiest and cheapest way to expand your bandwidth’ said Jim Hayes, president of the Fiber Optic Association. But, he notes that a company introducing new technology to old fibre should characterise it first. One current trend is adding signals travelling through the optical L-band of the optical spectrum from 1565 to 1625nm to the C-band from 1530 to 1565nm. Hayes notes that it’s important to characterise fibre to look for stress-related attenuation of signals carried on wavelengths approaching 1625nm.

Helen Xenos, senior director, portfolio marketing, at Ciena, noted that including the L-band doubles the usable signal spectrum. A similar idea is extending the C-band to around 1575nm, sometimes called the ‘super C band’, but Xenos stressed that this is a smaller benefit. She added that conventionally C-band and L-band functions have been separated into different circuit packs that need to be interconnected, requiring costly site visits to add new components. ‘Then there’s the bigger issue that this is going to impact existing channels,’ she said. ‘You’re going to have to calibrate the system with both the C- and L-bands, and the Raman scattering impact that is present.’

Easier upgrades

Ciena’s 6500 Reconfigurable Line System (RLS) therefore integrates C- and L-band functions into new networks from installation, so that they can exploit the L-band without additional planning or amplifier site visits, or impacting existing traffic. ‘The C- and L-band amplifiers are integrated into the same circuit pack and are installed at all inline amplifier sites on day one,’ Xenos said. The 6500 RLS simulates the impact of extra wavelengths, using amplified spontaneous emission ASE noise loading across C- and L-bands. It can then optimise performance and ensure ‘very stable, optimal performance throughout the life of the network’.

The extra spectrum helps operators keep up with bandwidth growth as additional spectral efficiency gains from coherent technology drop off, Xenos observed. She revealed that ‘the vast majority’ of requests for proposals that Ciena receives for metro and long haul markets ask for combined C- and L-band solutions. For example, Swedish multinational fibre backbone group Telia Carrier announced it would be deploying the 6500 RLS in May 2020.

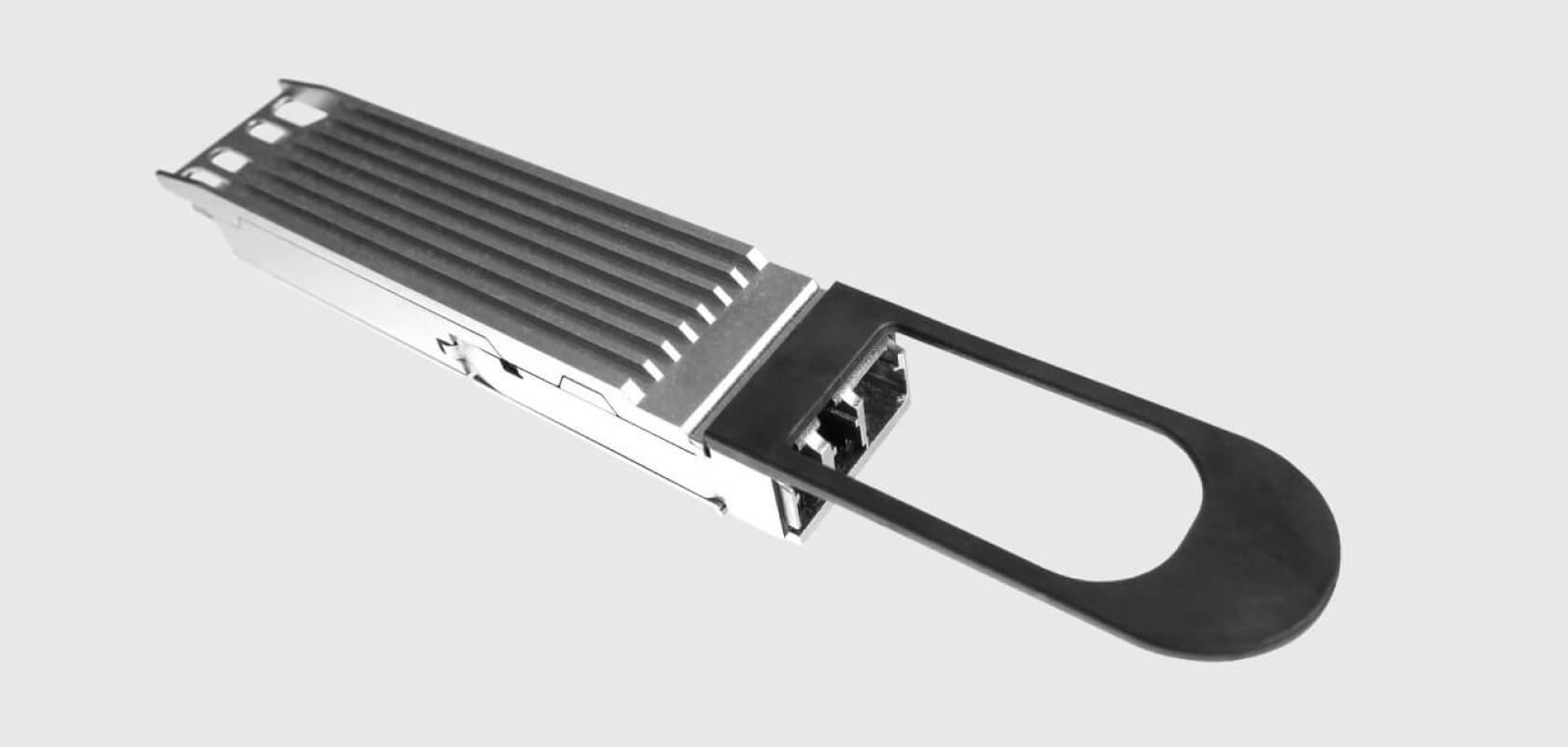

Gass noted that OIF’s involvement in metro networks is due to operators wanting smaller, lower power consumption digital signal processing (DSP) for coherent modulation systems. Companies approached OIF as it developed the 400ZR standard specifically for use in data centres. ‘We immediately had traditional telecom say, “That’s starting to look real close to a metro link,”’ he noted. As such, manufacturers are starting to sample new 400ZR products in pluggable modules in the form factors that could be used in metro networks.

However, Gass added that the US and Europe might struggle to upgrade their networks with the technology. ‘Since China’s still building, it is easiest to do first implementations there.’

Keep it simple

Through the history of Finisar, whose acquisition it completed last year, II-VI has long sold pluggable transceivers to connect servers and switches in data centres, highlighted Sanjai Parthasarathi, the company’s chief marketing officer. Pluggables can now simplify dense wavelength division multiplexing (DWDM) for DCI links across metro areas, he stressed. ‘We think this is a huge transformation. With 400GZR pluggables, you can go from a data centre switch to another data centre switch without any traditional line systems involved. Within the data centre, all they do is take a transceiver and connect it to a cable and that’s it, it autoconfigures. DWDM has almost always been highly complex.’

Sara Gabba, strategic marketing manager at II-VI, added that pluggability’s ease can also now extend to DWDM and coherent systems. In March it introduced its Pluggable Optical Line Subsystem (POLS), enabling pluggable 400ZR DWDM systems. POLS eliminates racking and other equipment external to the switch needed with rival systems, Gabba explained. This reduces capital expenditure, and also operating costs, because it’s cheaper to maintain, and needs less power and space, she said. ‘You can expect a three to five times cost saving with this solution,’ Gabba claimed.

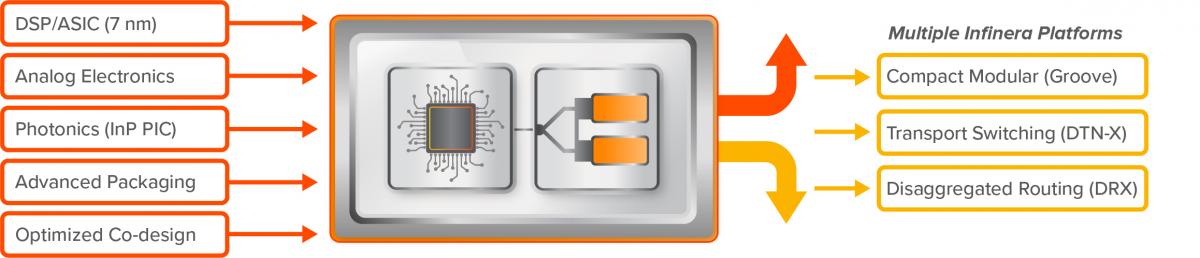

Meanwhile, half-size C form factor pluggable (CFP2) modules are ‘rapidly evolving as a ubiquitous pluggable form factor for 400G multi-rate metro transport platforms,’ according to Josef Berger, associate vice president of product marketing at Inphi. Coherent CFP2 modules consume around a quarter of the power of comparable line card solutions, while being more densely packable and ‘drastically reducing’ capital and operating expenditures, he added. ‘Operators are seeking pluggability for pay-as-grow and disaggregation for supply diversity,’ he said. System vendors can also exploit pluggability across a range of metro platforms with minimal engineering investment, Berger added. ‘New generations of low power multi-rate coherent DSPs like Inphi’s Canopus 7nm DSP and optics enable required 400G metro performance within CFP2 thermal

budgets.’

C-ing further

Inphi also offers even more compact pluggable form factors, such as its Colorz 100G quad small form-factor pluggable (QSFP) DWDM module for DCI reaches. It is also adopting the 400ZR standard and extending it for metro customers. ‘Late last year we started sampling our Colorz II 400ZR QSFP-Double Density (QSFP-DD) module,’ Berger said. ‘The ZR+ variant of this module will be able to address a significant portion of the metro market as well, so it will be interesting to see if a smaller form factor will be embraced by carriers for metro applications in order to improve cost, density and power consumption even further.’

The interoperability such standards enable is important. ‘For example, for the 400ZR standard, Inphi contributed its low power concatenated forward error correction (CFEC) to the industry in order to ensure interoperability between different DSPs and pluggable modules,’ Berger said. ‘Standards help to reduce fragmentation in the market and help both component and equipment vendors, as well as end-users to reduce costs and increase volumes. End-users have the additional advantage of de-risking their supply chain via multi-sourcing.’ He noted that to maximise fibre capacity while keeping costs low, cloud end- users want more channels than originally in the 400ZR standard. This will mean separating them by 75GHz, rather than 100GHz as specified. Expanding the optics beyond the conventional C-band is the next option beyond this, Berger

added.

However, NeoPhotonics already offers coherent components for the Super-C band, including tunable lasers, modulators and receivers. The company has also incorporated these product lines, called C++, into 400G-capable pluggable modules, said Ferris Lipscomb, NeoPhotonics’ vice president of marketing. ‘This approach is being deployed in China for new metro and long-haul networks and the ecosystem of amplifiers and other ROADM and monitoring equipment has been developed,’ Lipscomb explained.

‘This is a very attractive approach since it increases the total capacity of an optical fibre and retains the wavelength routing flexibility of current systems. Most importantly, the C++ band allows one part number for all key components and line-cards. We expect this architecture to be increasingly adopted in metro networks around the world.’

The approach is being implemented by China Mobile, and also in emerging point-to-point DCI networks based on pluggable 400ZR modules. Neophotonics also has a complete line of L-band components for coherent optics that operate at both 32 and 64GBd. However Lipscomb noted that using L-band wavelengths can be complex. ‘In current metro network architectures that route individual wavelengths to their destination with Wavelength Selective Switches (WSSs) and require amplification, operation of L-band channels requires separation of the C- and L-Band at every node to use separate amplifiers and WSSs, since there are none that can cover both bands,’ he said. ‘This adds quite a bit of complication and expense.’

Multipointing the way

Lipscomb suggests that the technology will initially only be used where the fibre-optic backbone is already saturated. ‘In the future, however, a metro architecture may emerge that is similar to DCI architectures and based on point-to-point transmission between switches and routers using pluggable ZR and ZR+ modules,’ he said. ‘In this architecture, L-band can be more easily accommodated, since all switching is done electronically. In existing networks, unless deployed to support L-band on day one, upgrading is very difficult, as there is generally not enough margin in the designs.’

Infinera’s Shore echoed this point. ‘Expanding the C-band makes sense in point-to-point data centre applications that are 130km or less because you don’t need amplifiers,’ he said. ‘Increasing fibre efficiency like this is not as significant in the metro, because it’s not that expensive to light.

’People are pushing to higher baud rates in the metro because it lowers the power and cost- per-bit. I have to plug in fewer physical devices when I do that.’ By including a pluggable optical layer in its compact modular Groove platform, Infinera supports interoperability for metro products. ‘Most network operators have really embraced that concept,’ Shore said. ‘They don’t want to have to be beholden to a single vendor.’

The next steps

Deploying 800Gb/s wavelengths is a natural next step for optical transmission, Infinera’s Bennett added. Some vendors ‘are positioning their 800G solutions with 100 to 200km reach, which would put them squarely in competition with low-cost 400ZR optics,’ he said.

‘In contrast, Infinera has demonstrated reach of up to 1,000km at 800G, over fibre types such as G.652, and this would allow 800G to be used in almost all metro network deployments.’

Shore also noted that metro networks are not usually point-to-point. ‘Traffic flows from a data centre out to hundreds of thousands of subscribers,’ he said. ‘The problem we have in metros is that if I put a 10G laser at one end of a link, I need an identical 10G laser at the other. If I have 10,000 edge locations, every edge location needs their own laser.’ Consequently Infinera has introduced its XR Optics technology to resolve this issue. ‘A single laser can communicate simultaneously with multiple endpoints and I can have a big transceiver in the hub and small transceivers at the edge,’ Shore stressed.

Despite commonalities between approaches, metro solutions are diverse.

‘Everyone is starting to realise that when we’re talking about metro networks there is no one “right” solution,’ Xenos summarised. ‘The right architecture choice is going to depend on existing network assets, capacity, reach, connectivity requirements needed and traffic growth expected.’

Andy Extance is a freelance science writer based in Exeter, UK

SSE Enterprise Telecoms is one of the fastest growing UK network operators in the UK. It offers high-capacity bandwidth services to enterprise and public sector customers and wholesale connectivity services through its 300-strong service provider community, as well as to mobile network operators addressing the all-important high performance 5G transport market. With an extensive 20,000km-plus fibre network that spans the UK, connecting more than 80 commercial data centres and more than 300 other points of presence, SSE Enterprise Telecoms has the capability to support services across the country.

Meeting the challenge of 5G bandwidth growth

SSE Enterprise Telecoms has invested in a new nationwide infrastructure to augment its existing network and facilitate the UK’s 5G requirements, supported by the recent partnership with Three UK to deliver core and regional connectivity to enable 5G.

With Three UK’s customers typically using up to 3.5 times more data than the average UK customer, it required a high-capacity, high-performance virtual network from SSE Enterprise Telecoms that would further support the bandwidth-hungry needs of 5G, as well as upgrade its existing 4G connectivity.

To enable this, SSE Enterprise Telecoms invested in one of the highest-capacity networks available in the UK, upgrading core and regional networks to support 100Gb/s connectivity and expanding its existing network footprint to 125 new BT exchanges. These BT exchanges have been ‘unbundled,’ meaning that UK network operators are able to take advantage of co-location space within the building, and can mix their own long distance and access connectivity with standardised local access circuits from Openreach.

SSE Enterprise Telecoms’ network needed to support both Layer 1 and Layer 2 services, as well as capacities up to 100Gb/s. Critically, due to the need to support multiple mobile wholesale customers, the network needed to support multiple synchronisation domains, at the same time as supporting demanding 5G performance criteria in areas such as low latency and synchronisation performance.

Furthermore, the network has been built not only to support Three UK’s 4G and 5G ambitions, it has also been built to aid the growing wholesale demand for high-capacity 10Gb/s and 100Gb/s connectivity services nationwide. SSE Enterprise Telecoms supports more than 300 wholesale customers through its quoting and ordering portal. The ability to provide multiple 10Gb/s services will make it a market leader in true UK-wide 10Gb/s services.

Network design built for the future

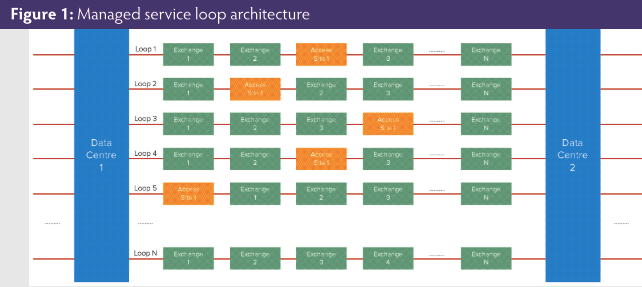

SSE Enterprise Telecoms selected a resilient design approach when investing in the network, ensuring it was future-proof. Each exchange required 100Gb/s connectivity to dual data centres to provide redundancy and the network also needed to connect additional access sites with 10Gb/s services. This requirement was achieved by creating a managed service loop architecture, in which pairs of data centres were interconnected by DWDM loops that connected the exchanges and access sites in a chain arrangement. Each data centre is required to terminate up to 20 loops.

The solution

After a comprehensive industry-wide selection process, SSE Enterprise Telecoms selected Infinera’s XTM Series as the underlying DWDM service delivery platform, as well as Infinera’s professional services capabilities. Utilising a fully ROADM-based optical layer and a combination of Layer 1 and Layer 2, 200Gb/s transport options, SSE Enterprise Telecoms can take advantage of the disaggregated system architecture of the XTM Series to enable a plug- and-play approach to support the managed service loop architecture.

The XTM Series provided a range of 200Gb/s coherent DWDM transport options to match the differing site requirements; 100Gb/s services via the 400Gb/s Flexponder that support 4x 100Gb/s over 2x 200Gb/s wavelengths, 10Gb/s services via the 200Gb/s Muxponder that supports a wide range of lower speed 10Gb/s services over a 200Gb/s wavelength and the EMXP440 that supports Layer 2 packet-optical aggregation with 200Gb/s wavelengths and 10Gb/s client ports.

Importantly, the platform - and therefore SSE Enterprise Telecoms’ network - is optimised for 5G synchronisation with very low latency asymmetry, to support 5G synchronisation over Layer 1 services and high-performance 1588v2 and SyncE performance for Layer 2 services. In addition, the switch-on-a-blade approach used in Layer 2 switching in the XTM Series provides distinct synchronisation domains per unit. This enables the network to support multiple customers with Layer 2 services and their own unique synchronisation domains, a feature not possible with solutions that are built around a single centralised Layer 2 switching fabric.

The results

SSE Enterprise Telecoms’ growing network has successfully enabled it to rapidly expand its service offering with reliable, dedicated, high capacity connectivity services providing the high-performance, scalability and flexibility needed for service differentiation in what is a very competitive market. The future looks promising for SSE Enterprise Telecoms to

continue its growth in the UK market, as 5G and Ethernet continue to grow and develop at a rapid pace.