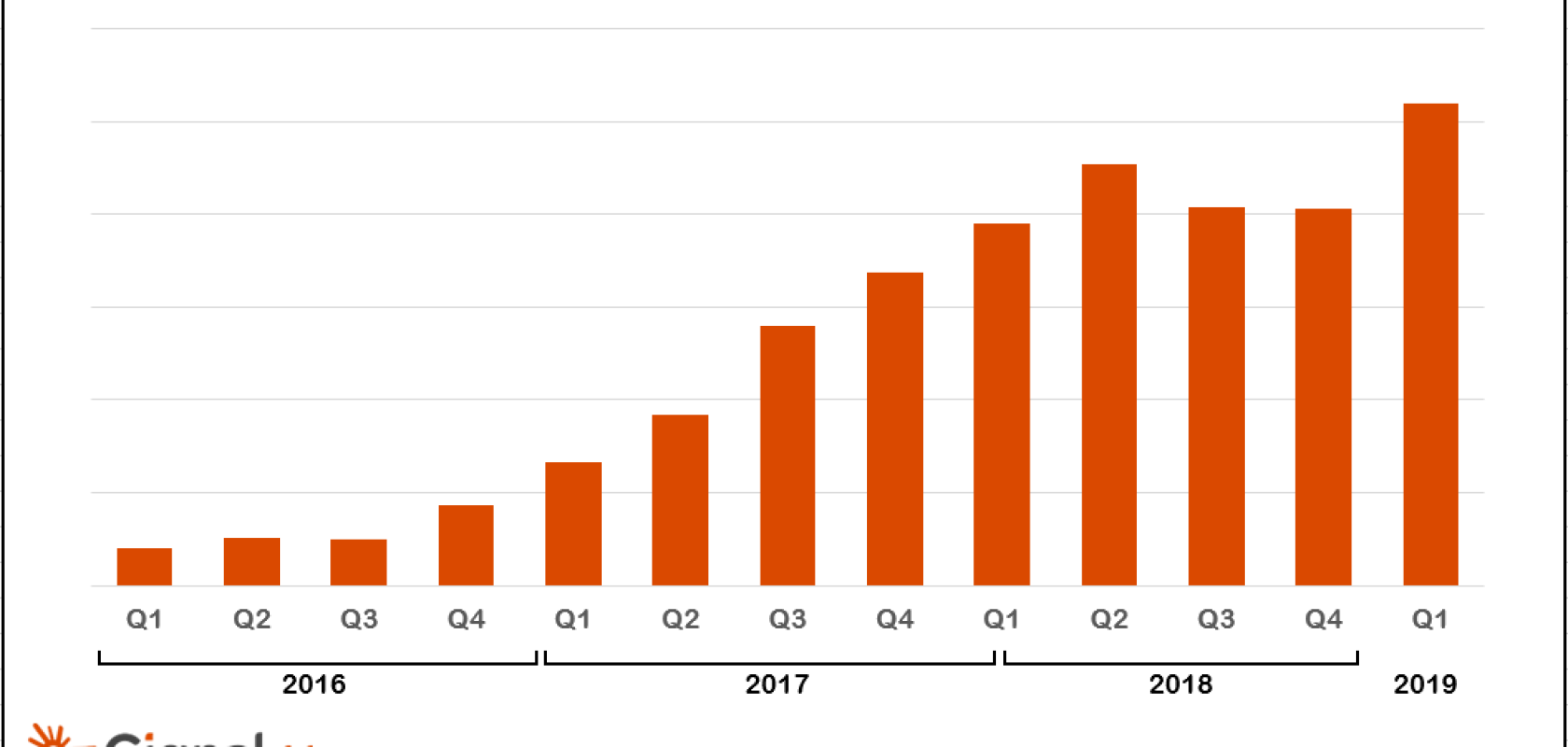

Industry market research firm, Cignal AI has released its 1Q19 Optical Applications Report.

Its findings show, amongst other things, that compact modular optical hardware is being used in more network applications than before, driving up sales during the first quarter of 2019.

The report illustrates significant growth throughout most regions as the compact modular customer base expands beyond cloud and webscale operators to include traditional telco customers pursuing network disaggregation. Compact modular hardware sales exceeded $275 million in Q1 and, says the report, they are on track to exceed $1 billion in revenue this year.

Issued quarterly, the report provides forecasts in three key markets: compact modular equipment, advanced packet-OTN switching hardware, and 100Gb/s+ coherent WDM port shipments across multiple speeds. Hardware and coherent port shipments are forecasted through 2023.

Growth was most pronounced in North America this quarter, where, said Cignal AI, it accounted for almost 30 per cent of the entire optical market. It is expected to continue advancing through 2023.

In terms of vendors, the report found that Ciena expanded its dominance in compact modular with more than 50 per cent market share in Q1. The combination of Infinera and Coriant held on to second place despite declining sales. In addition, Acacia AC1200-based platforms are expected to have an impact starting next quarter, whilst Cisco compact modular sales paused in Q1 in anticipation of the NCS1004 platform.

The Optical Applications Report states that 500k physical coherent ports have shipped in the last 12 months. Currently, more than 70 per cent of coherent ports are shipped by the top five vendors in the market. Referring to a 2018 recovery year, the report cites long-haul port shipments as starting to pick up, with metro growth advancing at a similar pace as next-generation coherent enables an upgrade from 100Gb/s. The report also says that packet OTN growth is slowing. New deployments are limited to China and parts of APAC as networks in other regions evolve away from the packet OTN architecture.

Scott Wilkinson, lead analyst for optical hardware at Cignal AI said: ‘Network applications for the compact modular form factor have expanded well beyond the original data centre interconnect deployments. Applications now include traditional telco networks, metro and long-haul deployments, and even some early trials for subsea deployment. We expect this spending trend to increase in 2019 as new compact modular products come to market from a variety of vendors.’

The company’s Optical Customer Markets Report for quarter 4 of 2018 was launched in April, and found that operator spending on optical hardware grew almost 50 per cent year-on-year to reach more than $1 billion in 2018.